Track Corporation acquired a large tract of land in a small town approximately 10 miles from Phoenix

Question:

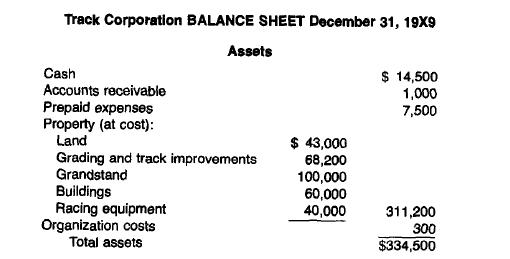

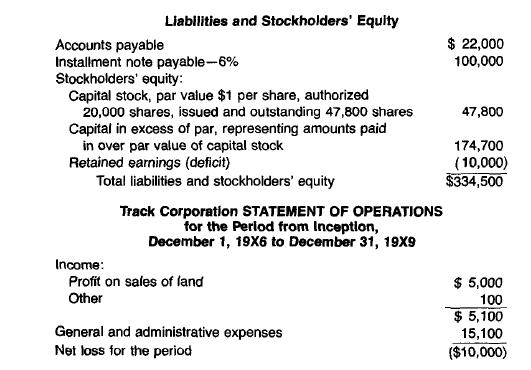

Track Corporation acquired a large tract of land in a small town approximately 10 miles from Phoenix City. The company executed a firm contract on November 15, 19X8 for the construction of a 1-mile race track, together with related facilities. The track and facilities were completed December 15, 19X9. On December 31, 19X9 a 6 percent installment note of \($100,000\) was issued, along with other consideration, in settlement of the construction contract. Installments of \($50,000\) fall due on December 31 of each of the next 2 years. The company planned to pay the notes from cash received from operations and from sale of additional capital stock. The company adopted the double-declining-balance method of computing depreciation. No depreciation was taken in 19X9 because all racing equipment was received in December after the completion of the track and facilities. The land on which the racing circuit was constructed was acquired at various dates for a total of \($43,000,\) and its approximate market value on December 31, 19X9 is \($60,000.\) Through the sale of tickets to spectators, parking fees, concession income, and income from betting, the company officials anticipated that approximately \($175,000\) would be taken in during the typical year's racing season. Cash expenses for a racing season were estimated at \($123,000.\) You have made an audit of the financial statements of Track as of December 31, 19X9. The balance sheet as of that date and statement of operations follow:

On January 15, 19X0, state legislation which declared betting to be illegal was enacted and was signed by the governor. A discussion with management on January 17 about the effect of the legislation revealed it is now estimated that revenue will be reduced to approximately \($48,000\) and cash expenses will be reduced to one- third the original estimate. Prepare the following:

1. The explanatory notes to accompany the balance sheet.

2. The most comprehensive auditor's opinion covering the balance sheet. The scope paragraph and explanatory paragraph, if any, should be omitted and the opinion dated February 1, 19X0.

3. If the report is in any way qualified as to opinion, give an explanation of your reasons for the qualification.

Step by Step Answer:

Auditing Concepts And Methods A Guide To Current Auditing Theory And Practice

ISBN: 9780070099999

5th Edition

Authors: Mcgraw-Hill