Mrs. Singer owns a profitable sole proprietorship. For each of the following cases, use Schedule SE, Form

Question:

Mrs. Singer owns a profitable sole proprietorship. For each of the following cases, use Schedule SE, Form 1040, to compute her 2021 self-employment tax and her income tax deduction for such tax.

a. Mrs. Singer’s net profit from Schedule C was $51,458. She had no other earned income.

b. Mrs. Singer’s net profit from Schedule C was $51,458, and she received a $110,000 salary from an employer.

c. Mrs. Singer’s net profit from Schedule C was $51,458, and she received a $155,000 salary from an employer.

Transcribed Image Text:

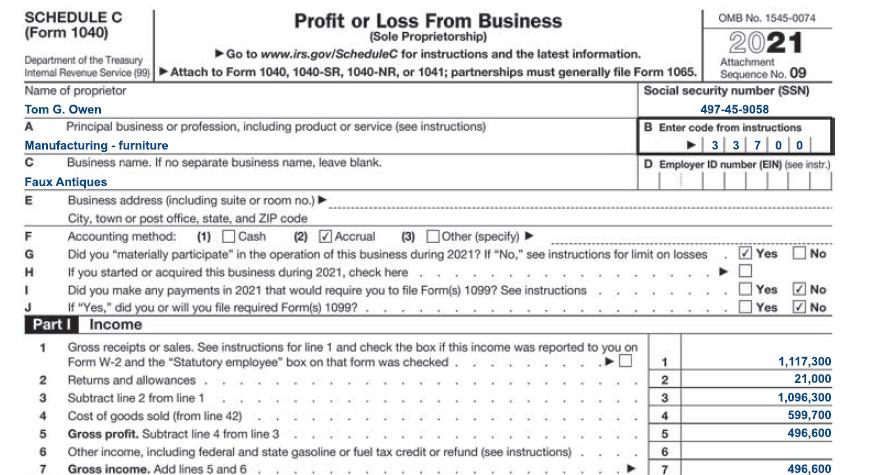

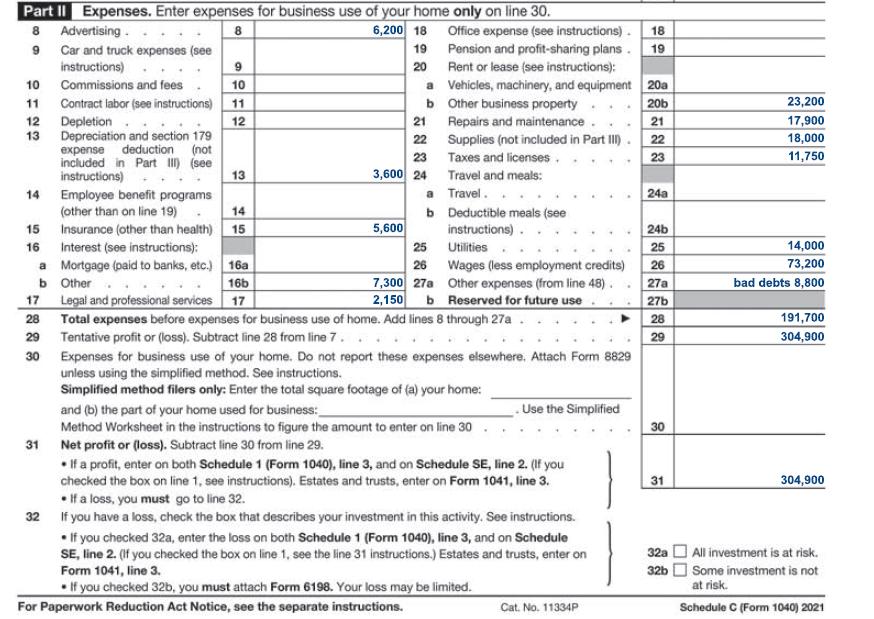

SCHEDULE C (Form 1040) ►Go to www.irs.gov/ScheduleC for instructions and the latest information. Department of the Treasury Internal Revenue Service (99) ► Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships must generally file Form 1065. Social security number (SSN) Name of proprietor Tom G. Owen A Principal business or profession, including product or service (see instructions) Manufacturing - furniture с Business name. If no separate business name, leave blank. Faux Antiques E F G 1 Part I Profit or Loss From Business (Sole Proprietorship) 2 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked. Returns and allowances. Subtract line 2 from line 1 Cost of goods sold (from line 42) Gross profit. Subtract line 4 from line 3 3 4 5 6 7 Business address (including suite or room no.) ► City, town or post office, state, and ZIP code Accounting method: (1) Cash (2) Accrual (3) Other (specify) Did you "materially participate in the operation of this business during 2021? If "No," see instructions for limit on losses If you started or acquired this business during 2021, check here Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions If "Yes," did you or will you file required Form(s) 1099?. Income Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) Gross income. Add lines 5 and 6 497-45-9058 B Enter code from instructions 33700 D Employer ID number (EIN) (see instr.) 1 2 OMB No. 1545-0074 2021 3₂ 4 5 6 7 Attachment Sequence No. 09 SO Yes No Yes Yes No No 1,117,300 21,000 1,096,300 599,700 496,600 496,600

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 40% (5 reviews)

a Mrs Singers 2021 selfemployment tax is 7271 and her income tax deduction is 3635 b Mrs Singers 2021 selfemployment tax is 5445 and her income tax deduction is 2723 c Mrs Singers 2021 selfemployment ...View the full answer

Answered By

Irfan Ali

I have a first class Accounting and Finance degree from a top university in the World. With 5+ years experience which spans mainly from the not for profit sector, I also have vast experience in preparing a full set of accounts for start-ups and small and medium-sized businesses. My name is Irfan Ali and I am seeking a wide range of opportunities ranging from bookkeeping, tax planning, business analysis, Content Writing, Statistic, Research Writing, financial accounting, and reporting.

4.70+

249+ Reviews

530+ Question Solved

Related Book For

Principles Of Taxation For Business And Investment Planning 2023

ISBN: 9781264229741

26th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick

Question Posted:

Students also viewed these Business questions

-

Mrs. Singer owns a profitable sole proprietorship. For each of the following cases, use a Schedule SE, Form 1040, to compute her 2014 self-employment tax and her income tax deduction for such tax. a....

-

Mrs. Singer owns a profitable sole proprietorship. For each of the following cases, use a Schedule SE, Form 1040, to compute her 2016 self-employment tax and her income tax deduction for such tax. a....

-

Mrs. Singer owns a profitable sole proprietorship. For each of the following cases, use a Schedule SE, Form 1040, to compute her 2017 self-employment tax and her income tax deduction for such tax. a....

-

A partially completed flowchart showing some of the major documents commonly used in the purchasing function of a merchandise business is presented below. Identify documents 1, 3, and4. Purchase Order

-

Baker Construction is a small corporation owned and managed by Tom Baker. The corporation has 21 employees, few creditors, and no investor other than Tom Baker. Thus, like many small businesses, it...

-

A float to be used as a level indicator is being designed to float in oil, which has a specific gravity of 0.90. It is to be a cube 100 mm on a side, and is to have 75 mm submerged in the oil....

-

Parents of minors took Apple to court in 2012 for supplying game applications, on iPhones, that were free but through which users could purchase in-game currencies. Apparently, parents would log on...

-

(Pension Worksheet) Webb Corp. sponsors a defined-benefit pension plan for its employees. On January 1, 2010, the following balances relate to this plan. Plan assets $480,000 Projected benefit...

-

Is Mongodb more efficient or faster in scaling than NoSQL?

-

At the beginning of 2022, Ms. Pope purchased a 20 percent interest in PPY Partnership for $20,000. Ms. Popes Schedule K-1 reported that her share of PPYs debt at year-end was $12,000, and her share...

-

Refer to the facts in the preceding problem. a. Complete Schedule K, Form 1065, for the partnership. b. Complete Schedule K-1, Form 1065, for Jayanthi. Data from Application Problems 21: Jayanthi and...

-

Sony Corporation manufactures and markets consumer electronics products. Selected income statement data for 2007 and 2008 follow (amounts in billions of yen): Required a. The analyst can sometimes...

-

The directors of Hillbeck Ltd wish to recognise a deferred tax asset in relation to 2 5 0 2 5 0 million of unused trading losses which have accumulated as at 3 1 3 1 December 2 0 2 2 . 2 0 2 2 ....

-

Calculate the net pay for the following employees using PDOC Employee 1 1 Salary 5 2 0 0 5 2 0 0 monthly Bonus 5 0 0 5 0 0 Car Allowance 3 0 0 ( 3 0 0 ( insurable , , taxable, cash benefit ) ) NCTB...

-

Suppose that Ivanhoe uses a periodic inventory system and has these account balances: Purchases $571,000; Purchase Returns and Allowances $11,800; Purchases Discounts $9,100; and Freight-In $14,300....

-

Nine tiles, each with a unique non - zero digit, are placed into a bag and shuffled. You pick four of them ( without replacement ) and they form a number in the order you drew them ( eg . if you drew...

-

A manufacturing company reports finished goods inventory of $36,200 on May 31 and $33,500 on June 30. The company reports $92,100 in total manufacturing costs and $93,170 in cost of goods...

-

Explain how each of the following changes as the number of degrees of freedom describing a t curve increases: a. The standard deviation of the t curve. b. The points t and t/2.

-

Calculate the change in entropy when 100 kJ of energy is transferred reversibly and isothermally as heat to a large block of copper at (i) 0 C, (ii) 50 C.

-

Hummingbird Corporation, a closely held C corporation that is not a PSC, has $40,000 of net active income, $15,000 of portfolio income, and a $45,000 loss from a passive activity. Compute...

-

Compute the charitable contribution deduction (ignoring the percentage limitation) for each of the following C corporations. a. Amber Corporation donated inventory of clothing (basis of $24,000, fair...

-

Art, an executive with Azure Corporation, plans to start a part-time business selling products on the Internet. He will devote about 15 hours each week to running the business. Arts salary from Azure...

-

Use hypothetical data where necessary. Question 1 Write an SQL query to differentiate between system privileges and object privileges in a Database. Question 2 You have a table named employees in...

-

in c++ please Digicup This program simulates interactions with a cup object for getting a drink, refilling a drink, emptying a drink, and drinking from it. Output All of the output statements...

-

1. A certain silicon gate NMOS transistor occupies an area of 252, where is the minimum lithographic feature size. (a) How many MOS transistors can fit on a 5 x 5 mm die if h = 0.5m? (b) 0.34 m? (c)...

Study smarter with the SolutionInn App