At the beginning of 2022, Ms. Pope purchased a 20 percent interest in PPY Partnership for $20,000.

Question:

At the beginning of 2022, Ms. Pope purchased a 20 percent interest in PPY Partnership for $20,000. Ms. Pope’s Schedule K-1 reported that her share of PPY’s debt at year-end was $12,000, and her share of ordinary loss was $28,000. On January 1, 2023, Ms. Pope sold her interest to another partner for $2,000 cash.

a. How much of her share of PPY’s loss can Ms. Pope deduct on her 2022 return?

b. Compute Ms. Pope’s recognized gain on sale of her PPY interest.

c. How would your answers to parts (a) and (b) change if PPY were an S corporation instead of a partnership?

Transcribed Image Text:

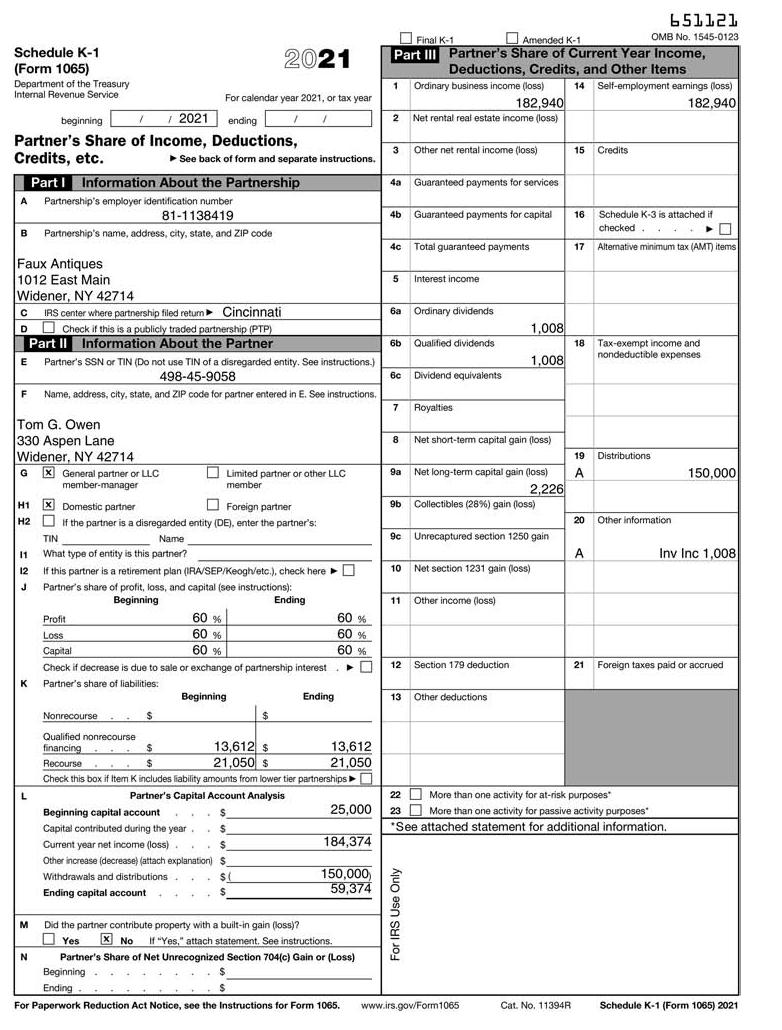

Schedule K-1 (Form 1065) Department of the Treasury Internal Revenue Service 1 / 2021 ending Partner's Share of Income, Deductions, Credits, etc. Faux Antiques 1012 East Main Part I Information About the Partnership A Partnership's employer identification number 81-1138419 B Partnership's name, address, city, state, and ZIP code E Widener, NY 42714 C IRS center where partnership filed retum Cincinnati I D Check if this is a publicly traded partnership (PTP) Part II Information About the Partner beginning Tom G. Owen 330 Aspen Lane Partner's SSN or TIN (Do not use TIN of a disregarded entity. See instructions.) 498-45-9058 F Name, address, city, state, and ZIP code for partner entered in E. See instructions. Widener, NY 42714 GX General partner or LLC member-manager H1 H2 11 12 K M N ► See back of form and separate instructions. For calendar year 2021, or tax year / 1 TIN Name What type of entity is this partner? Domestic partner Foreign partner If the partner is a disregarded entity (DE), enter the partner's: 2021 60 % 60 % 60 % $ If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here ► Partner's share of profit, loss, and capital (see instructions): Beginning Limited partner or other LLC member Profit Loss Capital Check if decrease is due to sale or exchange of partnership interest Partner's share of liabilities: Beginning . Beginning capital account Capital contributed during the year $ 8 Current year net income (loss). $ Other increase (decrease) (attach explanation) S Withdrawals and distributions $( $ Ending capital account . Partner's Capital Account Analysis $ Y Ending Nonrecourse Qualified nonrecourse financing $ 13,612 $ 21,050 $ Recourse $ Check this box if Item K includes liability amounts from lower tier partnerships . $ $ Ending 60 % 60 % 60 % ➤ 0 13,612 21,050 25,000 184,374 150,000) 59,374 Did the partner contribute property with a built-in gain (loss)? Yes No If "Yes," attach statement. See instructions. Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) Beginning Ending For Paperwork Reduction Act Notice, see the Instructions for Form 1065. Final K-1 Amended K-1 Part III Partner's Share of Current Year Income, Deductions, Credits, and Other Items 1 2 3 4a 4b 4c 5 6b 7 8 6a Ordinary dividends Ordinary business income (loss) 182,940 Net rental real estate income (loss) 11 Other net rental income (loss) 6c Dividend equivalents 12 Guaranteed payments for services 13 Guaranteed payments for capital Total guaranteed payments Interest income For IRS Use Only Qualified dividends Royalties 9a Net long-term capital gain (loss) 2,226 9b Collectibles (28%) gain (loss) 9c Unrecaptured section 1250 gain 10 Net section 1231 gain (loss) Net short-term capital gain (loss) 1,008 Other income (loss) 1,008 Section 179 deduction Other deductions www.irs.gov/Form1065 14 Self-employment earnings (loss) 182,940 15 Credits 16 17 18 651121 OMB No. 1545-0123 Schedule K-3 is attached if checked Alternative minimum tax (AMT) items 19 Distributions A A Tax-exempt income and nondeductible expenses 20 Other information. 22 More More than one activity for at-risk purposes 23 More than one activity for passive activity purposes *See attached statement for additional information. 150,000 Inv Inc 1,008 21 Foreign taxes paid or accrued Cat. No. 11394R Schedule K-1 (Form 1065) 2021

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 25% (4 reviews)

a Ms Popes initial cost basis in her partnership interest Increas...View the full answer

Answered By

Nyron Beeput

I am an active educator and professional tutor with substantial experience in Biology and General Science. The past two years I have been tutoring online intensively with high school and college students. I have been teaching for four years and this experience has helped me to hone skills such as patience, dedication and flexibility. I work at the pace of my students and ensure that they understand.

My method of using real life examples that my students can relate to has helped them grasp concepts more readily. I also help students learn how to apply their knowledge and they appreciate that very much.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Principles Of Taxation For Business And Investment Planning 2023

ISBN: 9781264229741

26th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick

Question Posted:

Students also viewed these Business questions

-

At the beginning of 2015, Ms. P purchased a 20 percent interest in PPY Partnership for $20,000. Ms. Ps Schedule K-1 reported that her share of PPYs debt at year-end was $12,000 and her share of...

-

At the beginning of 2017, Ms. P purchased a 20 percent interest in PPY Partnership for $20,000. Ms. P's Schedule K-1 reported that her share of PPY's debt at year-end was $12,000, and her share of...

-

At the beginning of 2018, Ms. P purchased a 20 percent interest in PPY Partnership for $20,000. Ms. Ps Schedule K-1 reported that her share of PPYs debt at year-end was $12,000, and her share of...

-

After its move in 1990 to La Junta, Colorado, and its new initiatives, the DeBourgh Manufacturing Company began an upward climb of record sales. Suppose the figures shown here are the DeBourgh...

-

Does the term debit mean increase and the term credit mean decrease? Explain.

-

The instrument package shown in Fig. 5.18 weighs 258 N. Calculate the tension in the cable if the package is completely submerged in seawater having a specific weight of 10.05 kN/m 3 . Water surface...

-

When the plaintiff was 16, he was employed by Kmart as a cashier. At the end of his training, he was required to read Kmarts policy agreement, which included an agreement to submit all employment...

-

Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2014, were as follows: a. Issued 15,000 shares of $20 par common stock at $30, receiving cash. b....

-

10. Suppose f(x) = x - 2. Use the centered difference method with h = 0.1 to approximate f'(1).

-

Luong Corporation, a calendar year, accrual basis corporation, reported $1 million of net income after tax on its financial statements prepared in accordance with GAAP. The corporations books and...

-

Mrs. Singer owns a profitable sole proprietorship. For each of the following cases, use Schedule SE, Form 1040, to compute her 2021 self-employment tax and her income tax deduction for such tax. a....

-

Are ethical dilemmas faced by entrepreneurs more difficult to manage than those faced by others? Why or why not?

-

Gross Book Value of a fixed assets is its cost less depreciation Historical cost fair market value More than one of the above None of the above

-

Sameta Company was established in 2007 to give subsided services to Nairobians in water provision. The company is characterized by the following features: 1. Has 300 employees 2. Engages in expansion...

-

A company is commissioned to build an airport, starting at January, 1 year 01. The building is finished three years later (December, 31 year 03). The contract price was originally agreed to be 200...

-

Create a java program based on the uml. -int ID (read only) -String name -double unitPrice -int quantity +Item() +Item(int id, String name, double unitPrice, int quantity) +Item(Item sourceltem, int...

-

which item must be separately stated on form 1120S? A. advertising revenue B. gross ticket sales C. cost of goods sold D. investment interest

-

Using Table A. 4 (page 608), find t.100, t .025, and t.001 based on 11 degrees of freedom. Also, find these t points based on 6 degrees of freedom.

-

Match the following. Answers may be used more than once: Measurement Method A. Amortized cost B. Equity method C. Acquisition method and consolidation D. Fair value method Reporting Method 1. Less...

-

When are C corporations required to make estimated tax payments? How are these payments calculated?

-

Schedule M1 of Form 1120 is used to reconcile financial net income with taxable income reported on the corporations income tax return as follows: net income per books + additions subtractions =...

-

In the current year, Woodpecker, Inc., a C corporation with $8.5 million in assets, deducted amortization of $40,000 on its financial statements and $55,000 on its Federal tax return. Is Woodpecker...

-

The following data contains days when road rage occurred according to a study, The goal of the study is to determine when road rage occurs most often....

-

For the following exercise, find the domain and range of the function below using interval notation. 10 9 8- 7 6 5 + 3 10 -9 8-7-6 -3-2 1 2 4 5 6 7 8 9 16 Domain: Range: 2345 -5- -6 7 -8 9 10-

-

an investment of $12,000 earns an interest of 2.5% per year compounded monthly, for 6 years. calculate the Future value and effective annual interest rate

Study smarter with the SolutionInn App