Ms. Seagram paid $155,000 for a house that she occupied as her principal residence until February 1,

Question:

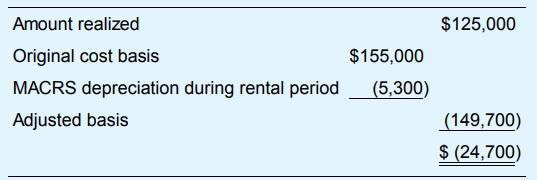

Ms. Seagram paid $155,000 for a house that she occupied as her principal residence until February 1, when she moved out and converted the house to rental property. The appraised FMV of the house was $140,000. She leased the house to tenants who purchased it on November 18. Her realized loss on the sale was $24,700, computed as follows.

Transcribed Image Text:

Amount realized $125,000 Original cost basis $155,000 MACRS depreciation during rental period (5,300) Adjusted basis (149,700) $ (24,700)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 42% (19 reviews)

Can Ms Seagram deduct her entire 24700 realized los...View the full answer

Answered By

Larlyu mosoti

I am a professional writer willing to do several tasks free from plagiarism, grammatical errors and submit them in time. I love to do academic writing and client satisfaction is my priority. I am skilled in writing formats APA, MLA, Chicago, and Harvard I am a statistics scientist and I can help out in analyzing your data. I am okay with SPSS, EVIEWS, MS excel, and STATA data analyzing tools.

Statistical techniques: I can do linear regression, time series analysis, logistic regression, and some basic statistical calculations like probability distributions. . I'm ready for your working projects!

Services I would offer:

• Academic writing.

• Article writing.

• Data entry.

• PDF conversion.

• Word conversion

• Proofreading.

• Rewriting.

• Data analyzing.

The best reason to hire me:

- Professional and Unique work in writing.

- 100% satisfaction Guaranteed

- within required time Express delivery

- My work is plagiarism Free

- Great communication

My passion is to write vibrantly with dedication. I am loyal and confident to give my support to every client. Because Client satisfaction is much more important to me than the payment amount. A healthy client-contractor relationship benefits in the longer term. Simply inbox me if you want clean work.

5.00+

3+ Reviews

10+ Question Solved

Related Book For

Principles Of Taxation For Business And Investment Planning 2020

ISBN: 9781259969546

23rd Edition

Authors: Sally Jones, Shelley Rhoades Catanach

Question Posted:

Students also viewed these Business questions

-

Ms. SE paid $155,000 for a house that she occupied as her principal residence until February 1, when she moved out and converted the house to rental property. The appraised FMV of the house was...

-

A builder paid $120,000 for a house and lot. The value of the land was appraised at $65,000, and the value of the house at $55,000. The house was then torn down at an additional cost of $8,000 so...

-

The General Service Contractor Company paid $400,000 for a house and lot. The value of the land was appraised at $155,000 and the value of the house at $245,000. The house was then torn down at an...

-

A mathematical model for the inside of a bowl is obtained by rotating the curve x 2 + y 2 = 100 through 360 about the y-axis between y = 8 and y = 0. Each unit of x and y represents 1cm. a. Find the...

-

The 98.6 degree standard for human body temperature was derived by a German doctor in 1868. In an attempt to verify his claim, Mackowiak, Wasserman, and Levine took temperatures from 148 healthy...

-

You want to lease some space in an office building for 15 years with lease payments due at the start of each year. The market price for the space you need is $15,000,000 and you estimate maintenance...

-

Consider the multiple linear regression model for the rental price data in Problem 3.42. Problem 3.42 Table B.24 contains data on median family home rental price and other data for 51 US cities. Fit...

-

After examining all the potential projects, you discover that there are many more projects this year with positive NPVs than in a normal year. What two problems might this extra large capital budget...

-

2.2 EquiBank's long-term debt and stockholders' equity for December 31, 1999 is shown in the following list. The bank had 1 million shares outstanding, million Long-term debt $ 5 Preferred stock 20...

-

Given a database of the results of an election, find the number of seats won by each party. There are some rules to going about this: There are many constituencies in a state and many candidates who...

-

Mr. and Mrs. Ayala purchased their home one year ago. This year, a local government attempted to seize the home because the former residents had failed to pay their property taxes for 12 years. Mr....

-

Mr. Dix borrowed $600,000 to purchase 62 acres of undeveloped land and secured the debt with the land. He converted a three-room log cabin on the land to his principal residence. This year, he paid...

-

A radiator on a proposed satellite solar power station must dissipate heat being generated within the satellite by radiating it into space. The radiator surface has a solar absorptivity of 0.5 and an...

-

Compare your current bank or credit union checking account to at least two others according to the "three Cs" criteria. Be sure to include one Internet-only bank in the comparison. Describe which is...

-

Unless you are Dorothy in the Wizard of Oz, it may be hard to imagine how you could need homeowner's or renter's liability insurance to protect yourself from damages caused to others. Auto accidents...

-

During the 19221923 German hyperinflation, people reported receiving more money for returning their empty beer bottles than they had originally paid to buy full bottles. Could they have made a living...

-

Instead of using the total population, we might deflate cigarette sales by the number of people over the age of 18, since a person must be at least 18 years old to buy cigarettes legally. There were...

-

Using symmetry, find deflection, bending moment, and shear force in a continuous beam shown in the figure. Assume \(E=200 \mathrm{GPa}\) and \(I=10^{5} \mathrm{~mm}^{4}\). 20 N/mm 400 mm 400 mm 400 mm

-

Yates Manufacturing Ltd. is preparing its year-end financial statements. Yates is a private enterprise. The controller, Theo Kimbria, is confronted with several decisions about statement presentation...

-

Which of the following gives the range of y = 4 - 2 -x ? (A) (- , ) (B) (- , 4) (C) [- 4, ) (D) (- , 4] (E) All reals

-

GreenUp, a calendar year, accrual basis taxpayer, provides landscaping installation and maintenance services to its customers. In August 2015, GreenUp contracted with a university to renovate its...

-

Cornish Inc. is an accrual basis, calendar year taxpayer. In December, a flood damaged one of Cornishs warehouses, and Cornish contracted with a construction company to repair the damage. The company...

-

KLP, a calendar year corporation, sponsored a contest for its customers with a grand prize of $100,000 cash. Contestants could enter the contest from June 1 through November 30. KLP selected the...

-

The highest WACC is 11%, the baseline WACC is 7.4% and lowest WACCS is 2.8%. To derive a WACC that better accounts for extreme scenarios, you decide to assign the following probability weights: High-...

-

Give 2 examples of the ff: Statutory law Regulatory law Common law Include the title of each example and explain why you chose these examples ( 1 to 2 sentences ) . Note: Write your reference ( s )

-

The Adams family includes a financially well-informed couple, both aged 36, and two children aged 4 and 6. The family is financially sound but suffered badly during the tech meltdown in 2000. The...

Study smarter with the SolutionInn App