Question

a) The current stock price is So =100. Clearly show how you can construct a long strangle using call and put options (on the

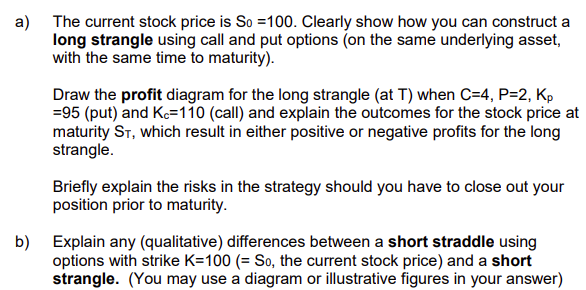

a) The current stock price is So =100. Clearly show how you can construct a long strangle using call and put options (on the same underlying asset, with the same time to maturity). Draw the profit diagram for the long strangle (at T) when C-4, P=2, Kp =95 (put) and Kc=110 (call) and explain the outcomes for the stock price at maturity ST, which result in either positive or negative profits for the long strangle. Briefly explain the risks in the strategy should you have to close out your position prior to maturity. b) Explain any (qualitative) differences between a short straddle using options with strike K=100 (= So, the current stock price) and a short strangle. (You may use a diagram or illustrative figures in your answer)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Long Strangle Construction A long strangle involves buying an outofthemoney call option and an outofthe money put option with the same expiration da...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started