Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below is an extracts from Eco bank and Cal Bank financial statements; Extracts from statements of financial position Equity & Liabilities Eco Bank Cal

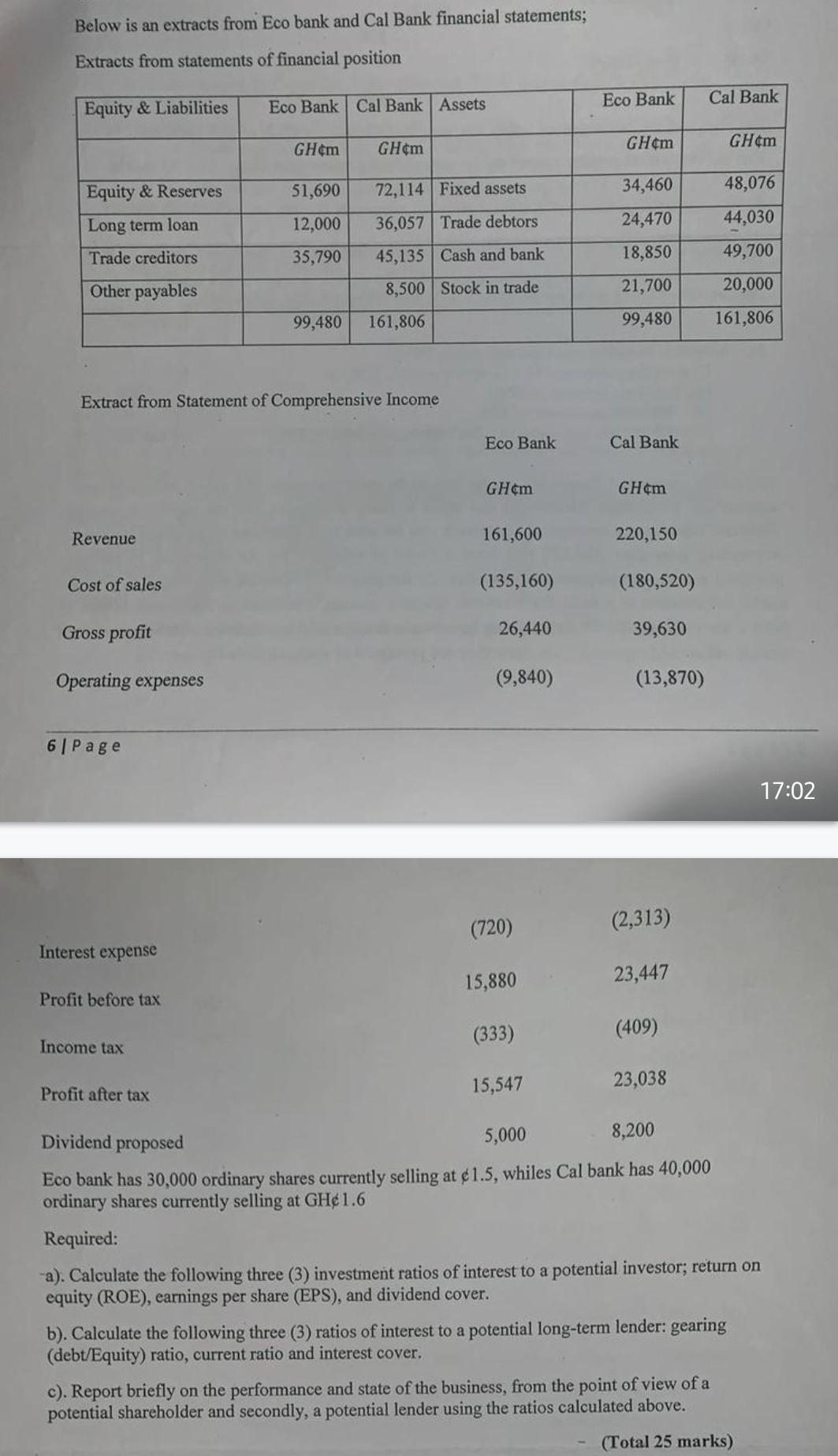

Below is an extracts from Eco bank and Cal Bank financial statements; Extracts from statements of financial position Equity & Liabilities Eco Bank Cal Bank Assets Eco Bank Cal Bank GHm GHm GHm GHm Equity & Reserves 51,690 72,114 Fixed assets 34,460 48,076 Long term loan 12,000 36,057 Trade debtors 24,470 44,030 Trade creditors 35,790 45,135 Cash and bank 18,850 49,700 Other payables 8,500 Stock in trade 21,700 20,000 99,480 161,806 99,480 161,806 Extract from Statement of Comprehensive Income Eco Bank Cal Bank GHm GHm Revenue 161,600 220,150 Cost of sales (135,160) (180,520) Gross profit 26,440 39,630 Operating expenses (9,840) (13,870) 6| Page (720) (2,313) Interest expense 15,880 23,447 Profit before tax Income tax (333) (409) Profit after tax 15,547 23,038 Dividend proposed 5,000 8,200 Eco bank has 30,000 ordinary shares currently selling at 1.5, whiles Cal bank has 40,000 ordinary shares currently selling at GH1.6 Required: -a). Calculate the following three (3) investment ratios of interest to a potential investor; return on equity (ROE), earnings per share (EPS), and dividend cover. b). Calculate the following three (3) ratios of interest to a potential long-term lender: gearing (debt/Equity) ratio, current ratio and interest cover. c). Report briefly on the performance and state of the business, from the point of view of a potential shareholder and secondly, a potential lender using the ratios calculated above. (Total 25 marks) 17:02

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculation of investment ratios 1 Return on Equity ROE ROE Profit after tax Equity Reserves 100 For Eco Bank ROE 15547 51690 100 3007 For Cal Bank ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started