Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blue Inc. has some flexibility to move manufacturing effort between shirts and pants production, with the current procedures enforcing limits on the maximum and minimum

Blue Inc. has some flexibility to move manufacturing effort between shirts and pants production, with the current procedures enforcing limits on the maximum and minimum quantity of each product that can be created.

Known constraints are provided below:

- Machine hours available (total): Minimum 39,000 hours - Maximum 40,000 hours.

- The quantity of shirts that can be manufactured: Minimum 30,000 shirts to Maximum 60,000 shirts.

- The quantity of pants that can be manufactured: Minimum 20,000 pairs of pants to Maximum 40,000 pairs of pants.

For every machine hour, the labour cost associated with this is $6.00 per machine hour. Other

Required:

Required:

You must solve thedecisions using linear programming, and include your models in excel. Make sure to state your conclusion.

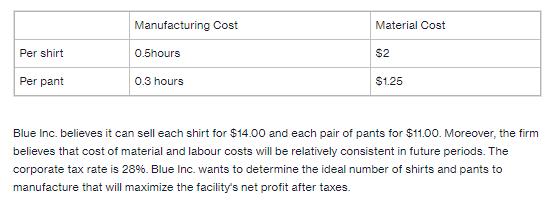

Per shirt Per pant Manufacturing Cost 0.5hours 0.3 hours Material Cost $2 $1.25 Blue Inc. believes it can sell each shirt for $14.00 and each pair of pants for $11.00. Moreover, the firm believes that cost of material and labour costs will be relatively consistent in future periods. The corporate tax rate is 28%. Blue Inc. wants to determine the ideal number of shirts and pants to manufacture that will maximize the facility's net profit after taxes.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine the ideal number of shirts and pants to manufacture that will maximize the facilitys net profit after taxes we can use linear programming ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started