Answered step by step

Verified Expert Solution

Question

1 Approved Answer

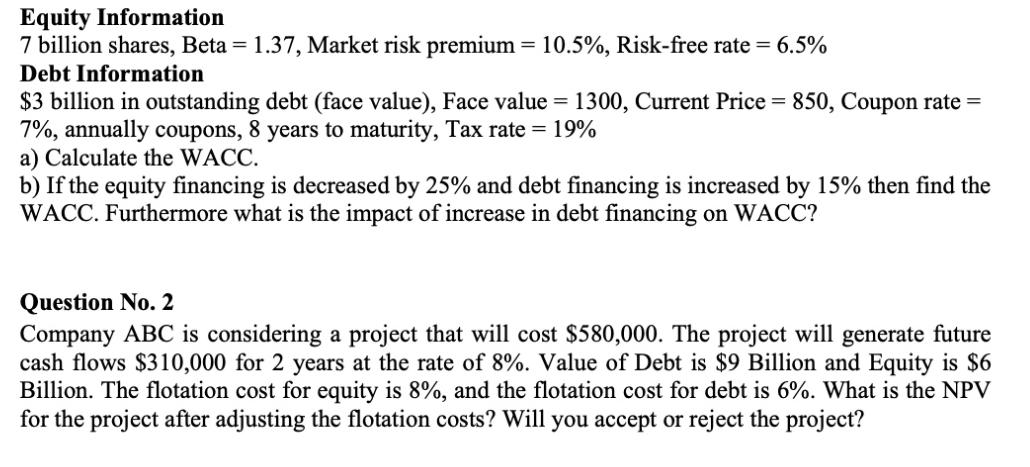

Equity Information == 7 billion shares, Beta = 1.37, Market risk premium = 10.5%, Risk-free rate = 6.5% Debt Information $3 billion in outstanding

Equity Information == 7 billion shares, Beta = 1.37, Market risk premium = 10.5%, Risk-free rate = 6.5% Debt Information $3 billion in outstanding debt (face value), Face value = 1300, Current Price = 850, Coupon rate = 7%, annually coupons, 8 years to maturity, Tax rate = 19% a) Calculate the WACC. b) If the equity financing is decreased by 25% and debt financing is increased by 15% then find the WACC. Furthermore what is the impact of increase in debt financing on WACC? Question No. 2 Company ABC is considering a project that will cost $580,000. The project will generate future cash flows $310,000 for 2 years at the rate of 8%. Value of Debt is $9 Billion and Equity is $6 Billion. The flotation cost for equity is 8%, and the flotation cost for debt is 6%. What is the NPV for the project after adjusting the flotation costs? Will you accept or reject the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete the table showing the dollar effects of the transactions on individual items of the acco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66427be786dec_979900.pdf

180 KBs PDF File

66427be786dec_979900.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started