Question

Consider the annual reports of bmw for 2022 uploaded.Using financial ratios, you are required to compare them and answer the following questions:Question 1: For the

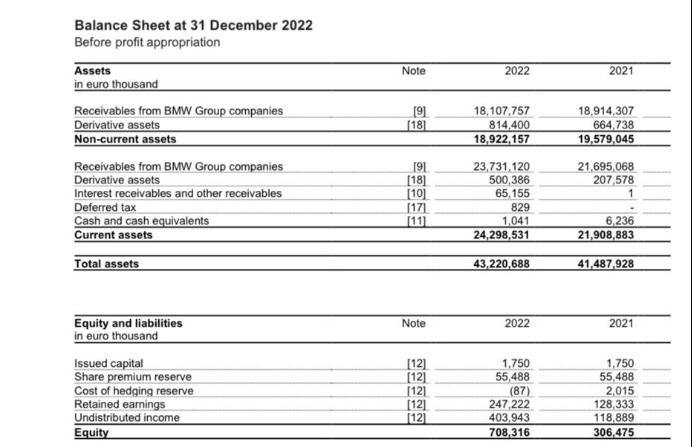

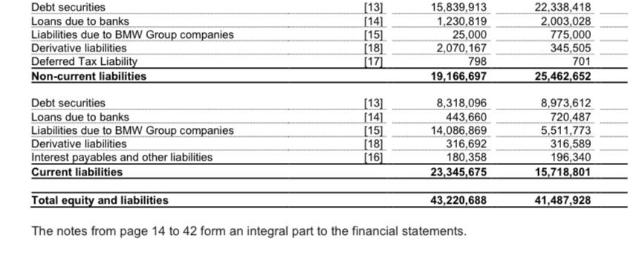

Consider the annual reports of bmw for 2022 uploaded.Using financial ratios, you are required to compare them and answer the following questions:Question 1: For the Balance sheet:* What is the percentage change of total assets? (Show calculations)* What is the percentage change of total Liabilities and total equity? (Show calculations)* Include 3 Ratio calculations for the balance sheet and show your formulas and calculations and explain your findings of each ratio.* Identify one strength and weakness and make recommendations for future improvement.11 of 54 BMW Finance N.v.

Balance Sheet at 31 December 2022 Before profit appropriation Assets in euro thousand Receivables from BMW Group companies Derivative assets Non-current assets Receivables from BMW Group companies Derivative assets Interest receivables and other receivables Deferred tax Cash and cash equivalents Current assets Total assets Equity and liabilities in euro thousand Issued capital Share premium reserve Cost of hedging reserve Retained earnings Undistributed income Equity Note [9] [18] [91 [18] [10] [17] [11] Note [12] [12] [12] [12] [12] 2022 18,107,757 814,400 18,922,157 23,731,120 500,386 65,155 829 1,041 24,298,531 43,220,688 2022 1,750 55,488 (87) 247,222 403,943 708,316 2021 18,914,307 664,738 19,579,045 21,695,068 207,578 1 6,236 21,908,883 41,487,928 2021 1,750 55,488 2,015 128,333 118,889 306,475 Balance Sheet at 31 December 2022 Before profit appropriation Assets in euro thousand Receivables from BMW Group companies Derivative assets Non-current assets Receivables from BMW Group companies Derivative assets Interest receivables and other receivables Deferred tax Cash and cash equivalents Current assets Total assets Equity and liabilities in euro thousand Issued capital Share premium reserve Cost of hedging reserve Retained earnings Undistributed income Equity Note [9] [18] [91 [18] [10] [17] [11] Note [12] [12] [12] [12] [12] 2022 18,107,757 814,400 18,922,157 23,731,120 500,386 65,155 829 1,041 24,298,531 43,220,688 2022 1,750 55,488 (87) 247,222 403,943 708,316 2021 18,914,307 664,738 19,579,045 21,695,068 207,578 1 6,236 21,908,883 41,487,928 2021 1,750 55,488 2,015 128,333 118,889 306,475

Step by Step Solution

3.23 Rating (130 Votes )

There are 3 Steps involved in it

Step: 1

DETAILED ANSWER To analyze the balance sheet of BMW Finance NV for the years 2022 and 2021 I will perform the following 1 Calculate the percentage change in total assets 2 Calculate the percentage cha...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started