Answered step by step

Verified Expert Solution

Question

1 Approved Answer

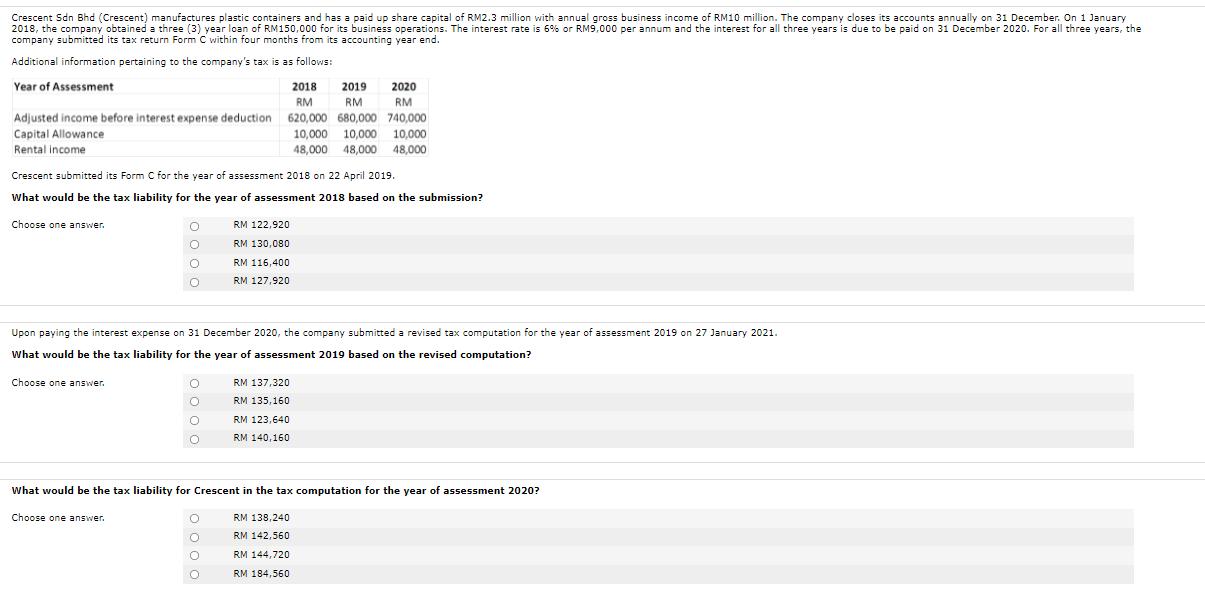

Crescent Sdn Bhd (Crescent) manufactures plastic containers and has a paid up share capital of RM2.3 million with annual gross business income of RM10

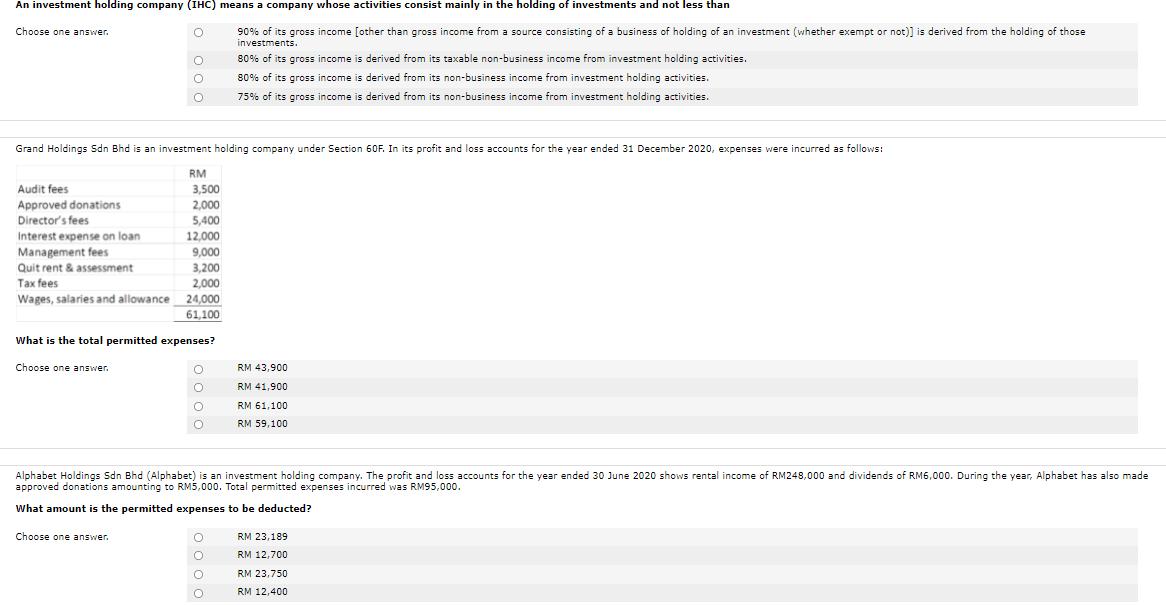

Crescent Sdn Bhd (Crescent) manufactures plastic containers and has a paid up share capital of RM2.3 million with annual gross business income of RM10 million. The company closes its accounts annually on 31 December. On 1 January 2018, the company obtained a three (3) year loan of RM150,000 for its business operations. The interest rate is 6% or RM9,000 per annum and the interest for all three years is due to be paid on 31 December 2020. For all three years, the company submitted its tax return Form C within four months from its accounting year end. Additional information pertaining to the company's tax is as follows: Year of Assessment Adjusted income before interest expense deduction Capital Allowance Rental income Crescent submitted its Form C for the year of assessment 2018 on 22 April 2019. What would be the tax liability for the year of assessment 2018 based on the submission? Choose one answer. O O O Choose one answer. Upon paying the interest expense on 31 December 2020, the company submitted a revised tax computation for the year of assessment 2019 on 27 January 2021. What would be the tax liability for the year of assessment 2019 based on the revised computation? O O 2018 2019 2020 RM RM RM 620,000 680,000 740,000 10,000 10,000 10,000 48,000 48,000 48,000 C O RM 122,920 RM 130,080 RM 116,400 RM 127,920 0000 RM 137,320 RM 135,160 RM 123,640 RM 140,160 What would be the tax liability for Crescent in the tax computation for the year of assessment 2020? Choose one answer. RM 138,240 RM 142,560 RM 144,720 RM 184,560 An investment holding company (IHC) means a company whose activities consist mainly in the holding of investments and not less than Choose one answer. O Audit fees Approved donations Director's fees Interest expense on loan 000 Grand Holdings Sdn Bhd is an investment holding company under Section 60F. In its profit and loss accounts for the year ended 31 December 2020, expenses were incurred as follows: RM Choose one answer. 3,500 2,000 5,400 12,000 9,000 Management fees Quit rent & assessment 3,200 Tax fees 2,000 Wages, salaries and allowance 24,000 61,100 What is the total permitted expenses? 0000 90% of its gross income [other than gross income from a source consisting of a business of holding of an investment (whether exempt or not)] is derived from the holding of those investments. 80% of its gross income is derived from its taxable non-business income from investment holding activities. 80% of its gross income is derived from its non-business income from investment holding activities. 75% of its gross income is derived from its non-business income from investment holding activities. 0000 RM 43,900 RM 41,900 RM 61,100 RM 59,100 Alphabet Holdings Sdn Bhd (Alphabet) is an investment holding company. The profit and loss accounts for the year ended 30 June 2020 shows rental income of RM248,000 and dividends of RM6,000. During the year, Alphabet has also made approved donations amounting to RM5,000. Total permitted expenses incurred was RM95,000. What amount is the permitted expenses to be deducted? Choose one answer. RM 23,189 RM 12,700 RM 23,750 RM 12,400

Step by Step Solution

★★★★★

3.58 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Crescent submitted its Form C for the year of assessment 2018 on 22 April 2019 What would be the tax liability for the year of assessment 2018 based o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started