Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jackson Corporation manufactures the following 3 products. Cost data for all 3 of their product offering is provided in the table below: Description Product

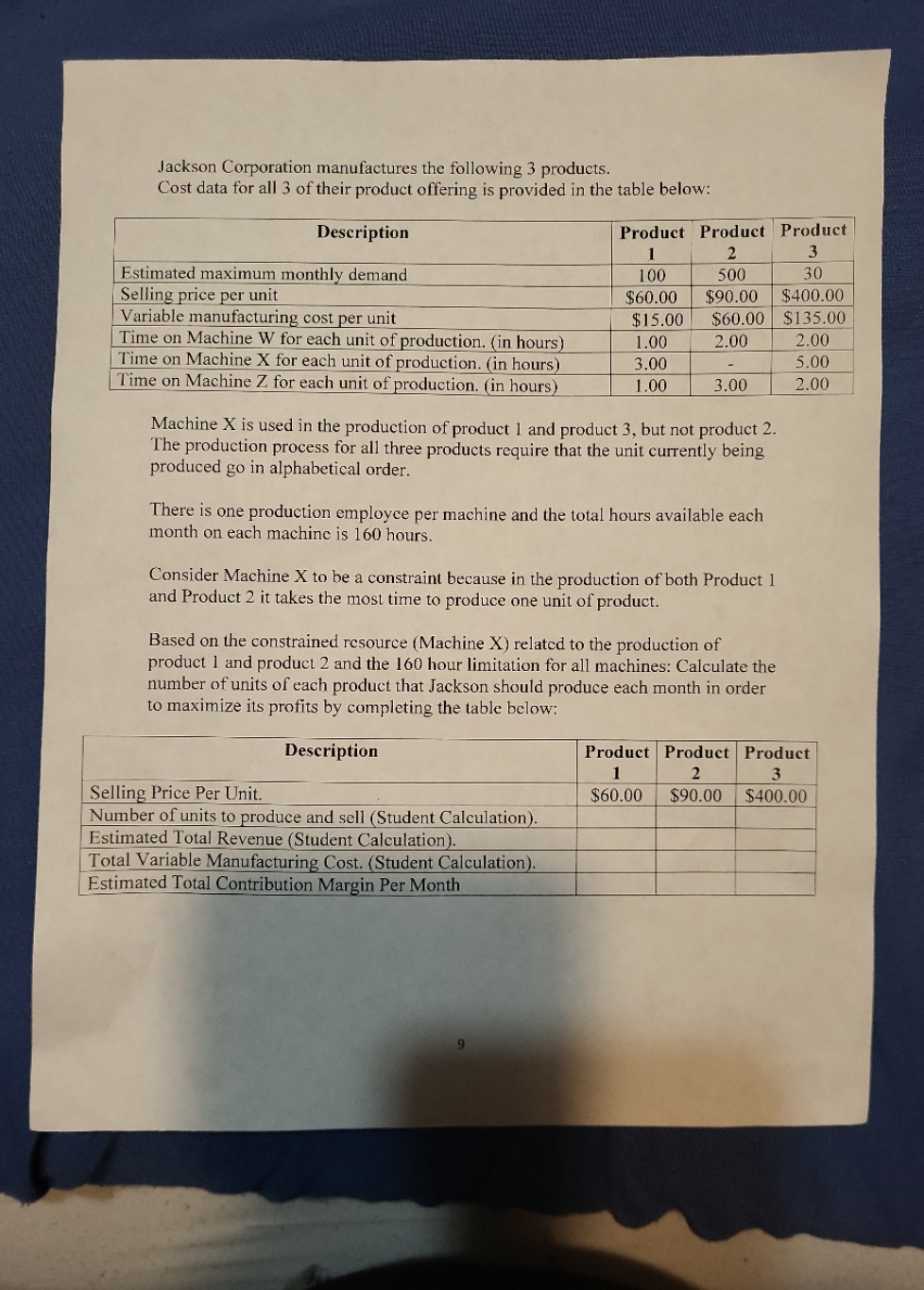

Jackson Corporation manufactures the following 3 products. Cost data for all 3 of their product offering is provided in the table below: Description Product Product Product 1 2 3 Estimated maximum monthly demand 100 500 30 Selling price per unit $60.00 $90.00 $400.00 Variable manufacturing cost per unit $15.00 $60.00 $135.00 Time on Machine W for each unit of production. (in hours) Time on Machine X for each unit of production. (in hours) Time on Machine Z for each unit of production. (in hours) 1.00 2.00 2.00 3.00 5.00 1.00 3.00 2.00 Machine X is used in the production of product 1 and product 3, but not product 2. The production process for all three products require that the unit currently being produced go in alphabetical order. There is one production employee per machine and the total hours available each month on each machine is 160 hours. Consider Machine X to be a constraint because in the production of both Product 1 and Product 2 it takes the most time to produce one unit of product. Based on the constrained resource (Machine X) related to the production of product 1 and product 2 and the 160 hour limitation for all machines: Calculate the number of units of each product that Jackson should produce each month in order to maximize its profits by completing the table below: Selling Price Per Unit. Description Number of units to produce and sell (Student Calculation). Estimated Total Revenue (Student Calculation). Total Variable Manufacturing Cost. (Student Calculation). Estimated Total Contribution Margin Per Month Product Product Product 1 2 3 $60.00 $90.00 $400.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To maximize profits we need to determine the optimal production quantities for each product b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started