Answered step by step

Verified Expert Solution

Question

1 Approved Answer

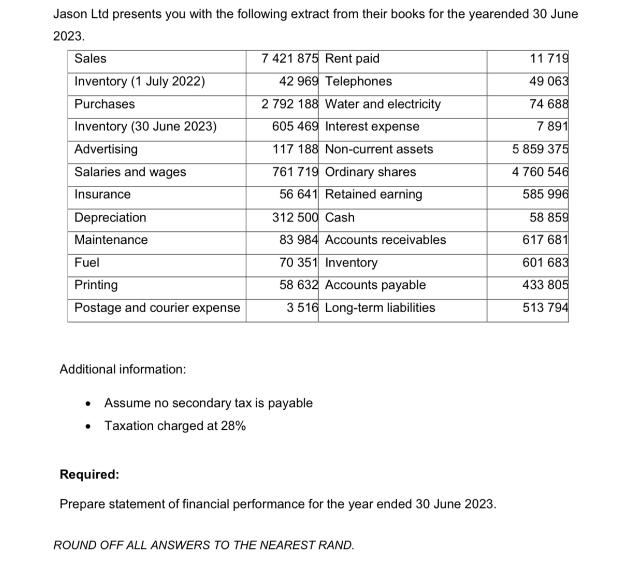

Jason Ltd presents you with the following extract from their books for the yearended 30 June 2023. Sales Inventory (1 July 2022) Purchases Inventory

![Question 4 marks] BMWX Ltd presents you with the following extract from their books for the year ended 30](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/10/651a73f0a2515_432651a73f09c2c1.jpg)

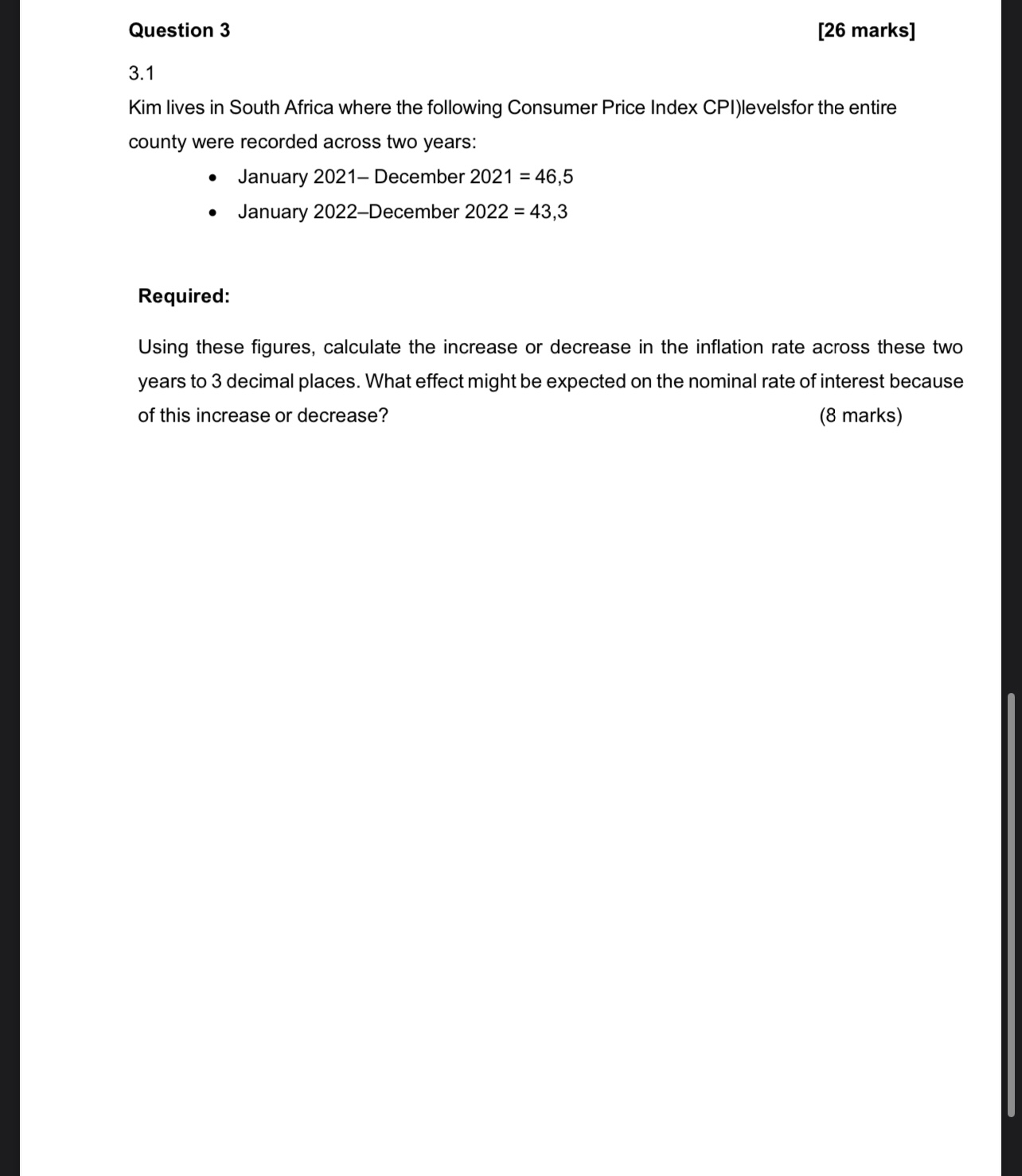

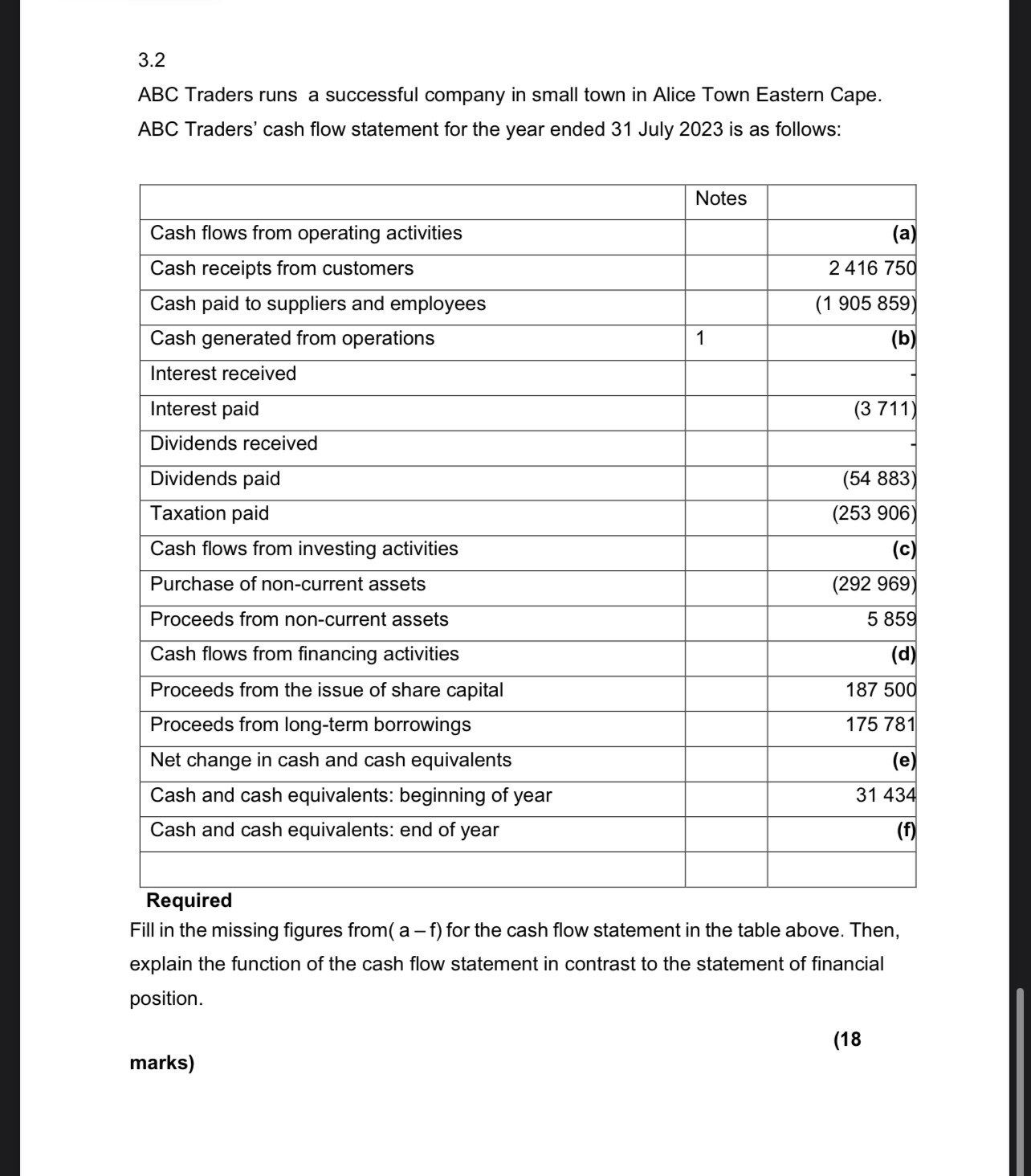

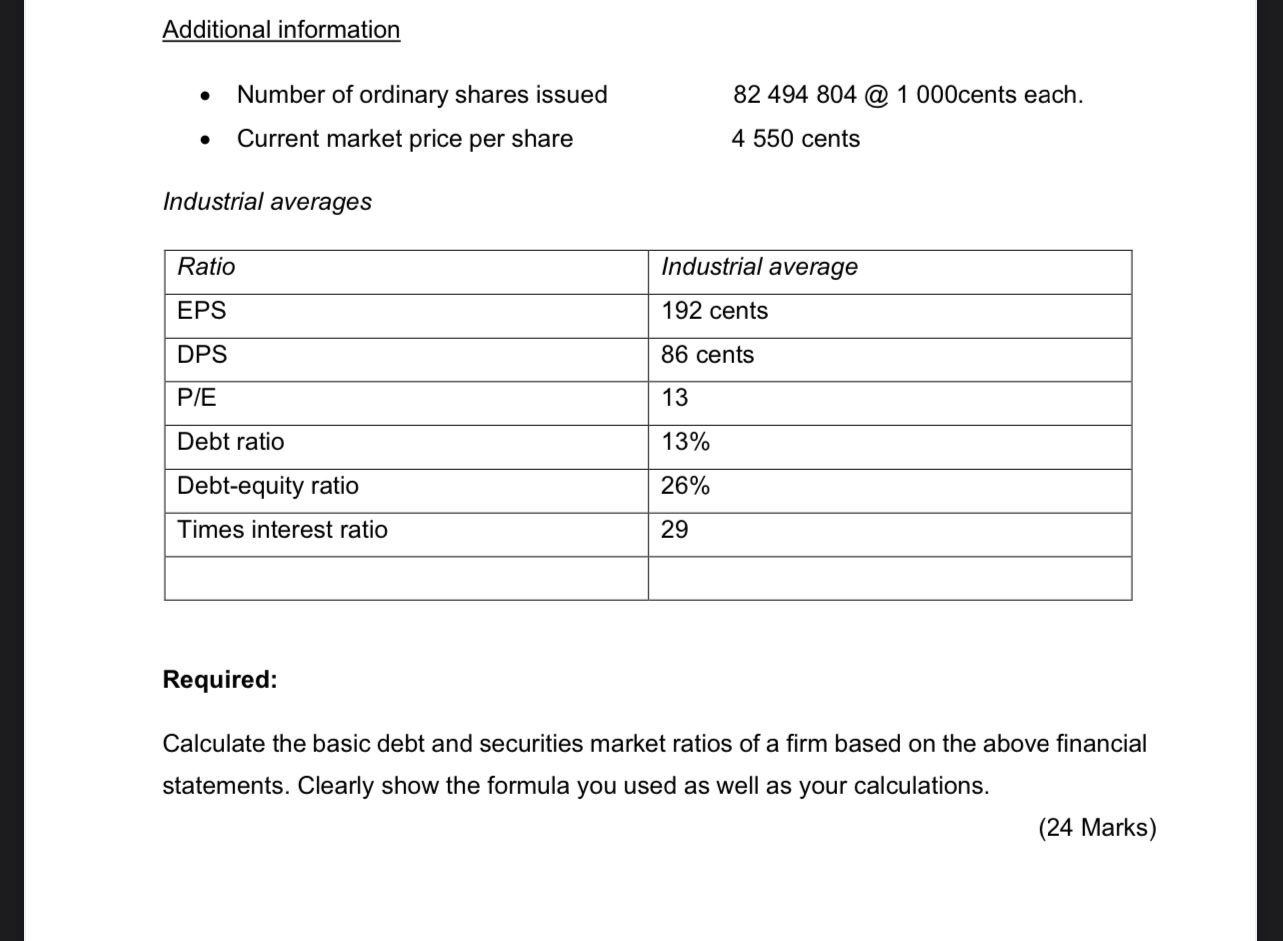

Jason Ltd presents you with the following extract from their books for the yearended 30 June 2023. Sales Inventory (1 July 2022) Purchases Inventory (30 June 2023) Advertising Salaries and wages Insurance Depreciation Maintenance Fuel Printing Postage and courier expense Additional information: 7 421 875 Rent paid 42 969 Telephones 2 792 188 Water and electricity 605 469 Interest expense 117 188 Non-current assets 761 719 Ordinary shares 56 641 Retained earning 312 500 Cash 83 984 Accounts receivables 70 351 Inventory 58 632 Accounts payable 3516 Long-term liabilities Assume no secondary tax is payable Taxation charged at 28% Required: Prepare statement of financial performance for the year ended 30 June 2023. ROUND OFF ALL ANSWERS TO THE NEAREST RAND. 11 719 49 063 74 688 7 891 5 859 375 4 760 546 585 996 58 859 617 681 601 683 433 805 513 794 Question 3 3.1 Kim lives in South Africa where the following Consumer Price Index CPI)levelsfor the entire county were recorded across two years: January 2021- December 2021 = 46,5 January 2022-December 2022 = 43,3 [26 marks] Required: Using these figures, calculate the increase or decrease in the inflation rate across these two years to 3 decimal places. What effect might be expected on the nominal rate of interest because of this increase or decrease? (8 marks) 3.2 ABC Traders runs a successful company in small town in Alice Town Eastern Cape. ABC Traders' cash flow statement for the year ended 31 July 2023 is as follows: Cash flows from operating activities Cash receipts from customers Cash paid to suppliers and employees Cash generated from operations Interest received Interest paid Dividends received Dividends paid Taxation paid Cash flows from investing activities Purchase of non-current assets Proceeds from non-current assets Cash flows from financing activities Proceeds from the issue of share capital Proceeds from long-term borrowings Net change in cash and cash equivalents Cash and cash equivalents: beginning of year Cash and cash equivalents: end of year Notes marks) 1 (a) 2 416 750 (1 905 859) (b) (3 711) (54 883) (253 906) (c) (292 969) 5 859 (d) 187 500 175 781 (e) 31 434 (f) Required Fill in the missing figures from( a - f) for the cash flow statement in the table above. Then, explain the function of the cash flow statement in contrast to the statement of financial position. (18 Question 4 marks] BMWX Ltd presents you with the following extract from their books for the year ended 30 June 2023 Statement of financial performance for the year ended 30 June 2023 Sales Less cost of sales Opening inventory Purchases Closing inventory Gross profit Less operating expenses Earnings before interest and taxes Less interest expense Earnings before tax Less tax (28%) Earnings after tax Net profit distributed as follows: Dividends to ordinary shareholders Retained earnings Statement of financial position as at 30 June 2023 90 158 111 Shareholder's interest Non-current assets Current assets Cash Account receivable Inventory Total assets 1 571 000 28 158 154 (1 587 114) 450 000 1 590 000 1 114 930 93 313 041 [24 Ordinary shares Retained earnings Long-term debt Current liabilities Accounts payable Equity and liabilities 75 105 000 28 142 040 46 962 960 (14 210 510) 32 752 450 (140 000) 32 612 450 (9 131 486) 23 480 964 5 406 005 18 074 959 23 480 964 82 494 804 8 690 543 1 236 694 891 000 93 313 041 Additional information Number of ordinary shares issued Current market price per share Industrial averages Ratio EPS DPS P/E Debt ratio Debt-equity ratio Times interest ratio 82 494 804 @ 1 000cents each. 4 550 cents Industrial average 192 cents 86 cents 13 13% 26% 29 Required: Calculate the basic debt and securities market ratios of a firm based on the above financial statements. Clearly show the formula you used as well as your calculations. (24 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Statement of Financial Performance for the Year Ended 30 June 2023 Revenue Sales 7421875 Expenses Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started