Question

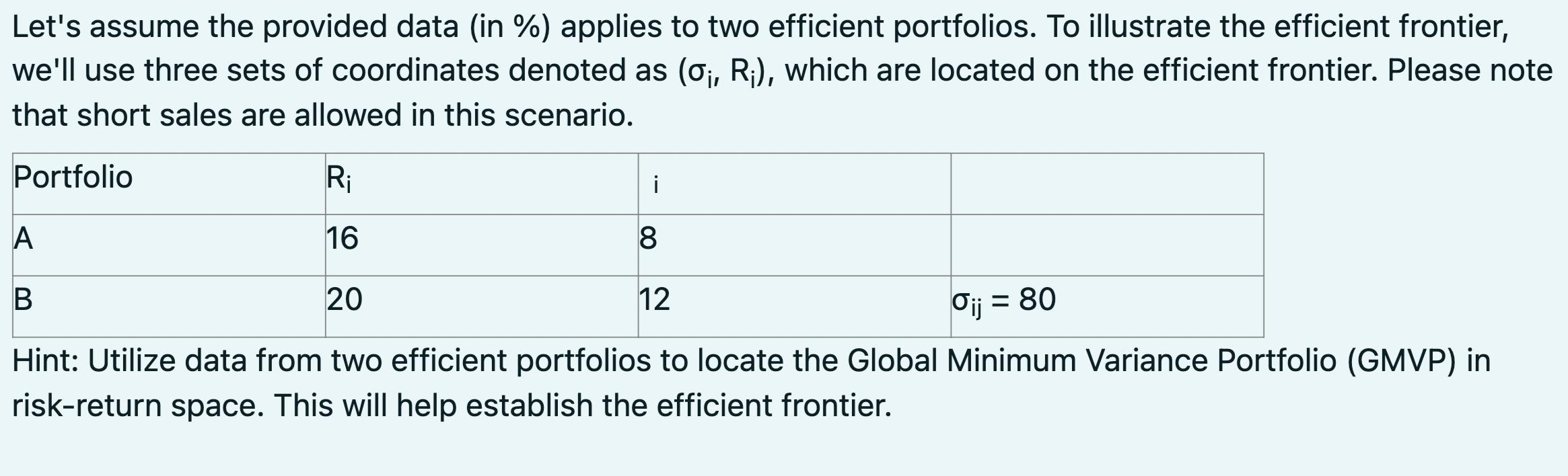

Let's assume the provided data (in %) applies to two efficient portfolios. To illustrate the efficient frontier, we'll use three sets of coordinates denoted

Let's assume the provided data (in %) applies to two efficient portfolios. To illustrate the efficient frontier, we'll use three sets of coordinates denoted as (0, R), which are located on the efficient frontier. Please note that short sales are allowed in this scenario. Portfolio R 16 20 Oij = 80 Hint: Utilize data from two efficient portfolios to locate the Global Minimum Variance Portfolio (GMVP) in risk-return space. This will help establish the efficient frontier. A B i 8 12

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To locate the Global Minimum Variance Portfolio GMVP and establish the efficient frontier we can uti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics An Intuitive Approach with Calculus

Authors: Thomas Nechyba

1st edition

538453257, 978-0538453257

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App