Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Litwick is a company that sells light bulbs with LED technology. The following is their typical income and costs. Sales Retailer price 4,000 units

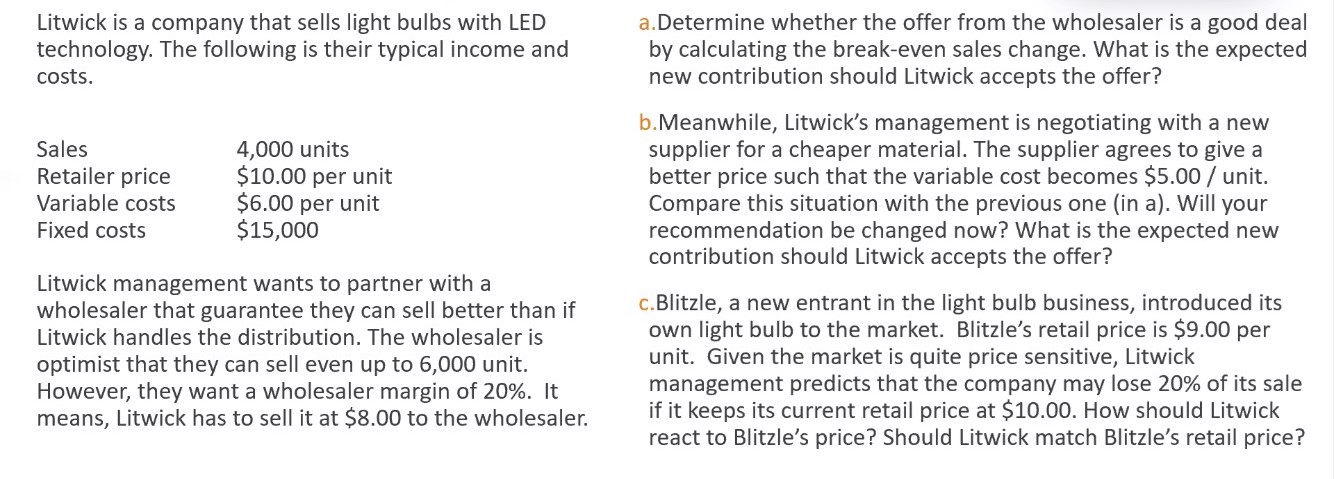

Litwick is a company that sells light bulbs with LED technology. The following is their typical income and costs. Sales Retailer price 4,000 units $10.00 per unit Variable costs Fixed costs $6.00 per unit $15,000 Litwick management wants to partner with a wholesaler that guarantee they can sell better than if Litwick handles the distribution. The wholesaler is optimist that they can sell even up to 6,000 unit. However, they want a wholesaler margin of 20%. It means, Litwick has to sell it at $8.00 to the wholesaler. a.Determine whether the offer from the wholesaler is a good deal by calculating the break-even sales change. What is the expected new contribution should Litwick accepts the offer? b.Meanwhile, Litwick's management is negotiating with a new supplier for a cheaper material. The supplier agrees to give a better price such that the variable cost becomes $5.00/ unit. Compare this situation with the previous one (in a). Will your recommendation be changed now? What is the expected new contribution should Litwick accepts the offer? c.Blitzle, a new entrant in the light bulb business, introduced its own light bulb to the market. Blitzle's retail price is $9.00 per unit. Given the market is quite price sensitive, Litwick management predicts that the company may lose 20% of its sale if it keeps its current retail price at $10.00. How should Litwick react to Blitzle's price? Should Litwick match Blitzle's retail price?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Determining Whether the Offer from the Wholesaler is a Good Deal To determine if the offer from th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664210cd5fa49_986607.pdf

180 KBs PDF File

664210cd5fa49_986607.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started