Question: Mr. Rivera and Mrs. Lopez are married, and they have 50 and 66 years respectively years old. Their income consisted of the following sources They

Mr. Rivera and Mrs. Lopez are married, and they have 50 and 66 years respectively years old. Their income consisted of the following sources

They have Salaries: Mr. Rivera $45,000 and Mr. Lopez $ 35,000

Interest received in Federal Bonds $1,000

Interest received in Private Banks Accounts $2,000

Jury Duty Compensation $3,000

Inheritance (Herencia recibida por Mrs. López) $10,000

Interest in Milwaukee city bonds 1,500

Withholding Tax payment $2,000 and 3,000

Please present computation items.

Make the follows calculations:

- Gross Income:

- Adjusted Gross Income:

- Standard Deduction

- Additional Standard Deduction:

- The taxable income is:

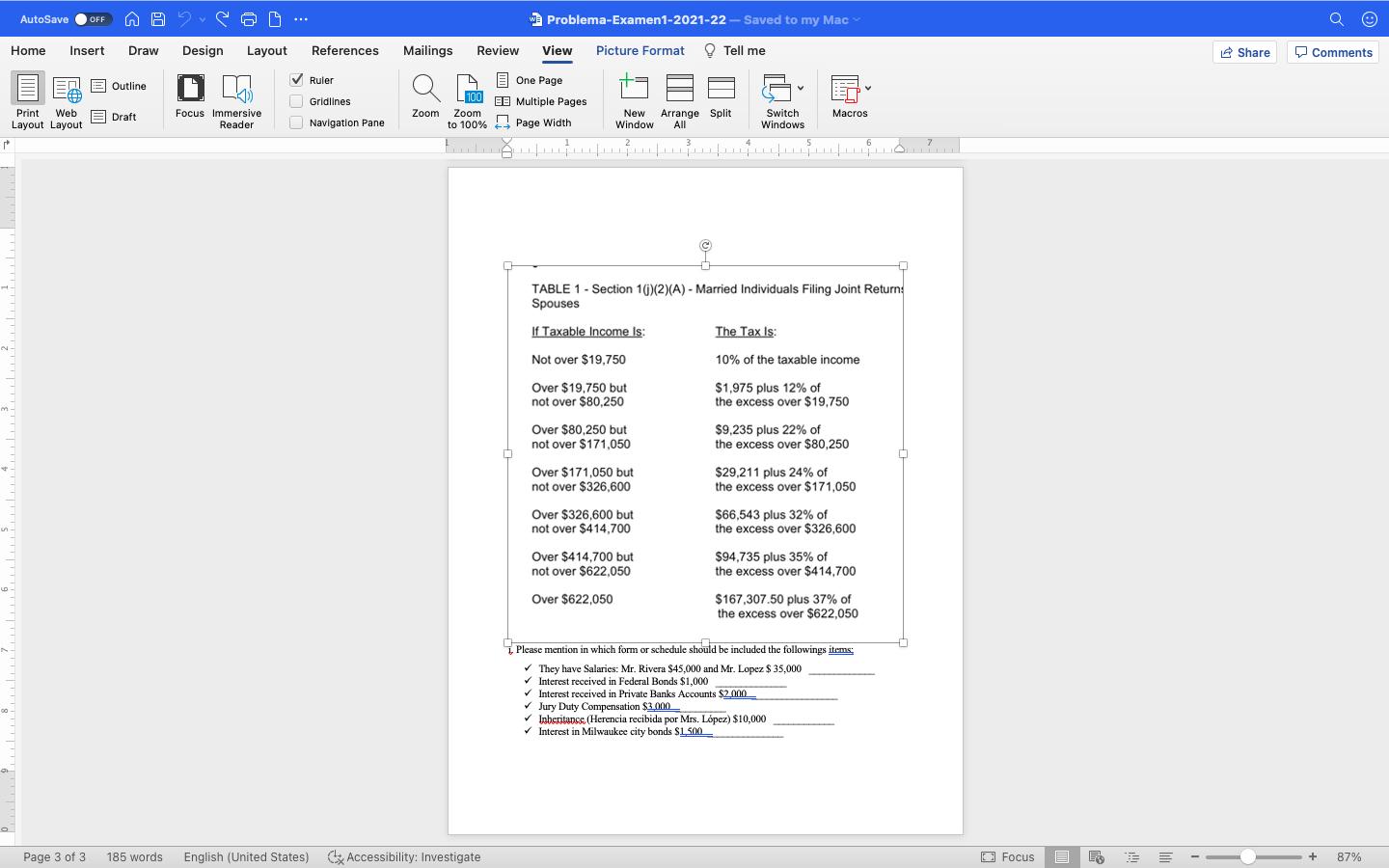

- The Total tax liability: (Please, use the table at the end of the problem)

- The Payment or Refund:

i. Please mention in which form or schedule should be included the followings items;

- They have Salaries: Mr. Rivera $45,000 and Mr. Lopez $ 35,000 _____________

- Interest received in Federal Bonds $1,000 ______________

- Interest received in Private Banks Accounts $2,000 _________________

- Jury Duty Compensation $3,000 __________

- Inheritance (Herencia recibida por Mrs. López) $10,000 ____________

- Interest in Milwaukee city bonds $1,500 _______________

r m in 00 AutoSave OFF Home Insert Draw Design Layout Print Web Layout Layout Page 3 of 3 | 1 Outline Draft Focus Immersive. Reader ... References Ruler Gridlines Navigation Pane Mailings Review 100 Zoom Zoom Problema-Examen1-2021-22-Saved to my Mac 185 words English (United States) Accessibility: Investigate View Picture Format - One Page EE Multiple Pages to 100% Page Width 1 New Arrange Split Window All 2 3 impoupanempuespuiq|m|mj If Taxable Income Is: Not over $19,750 Over $19,750 but not over $80,250 Over $80,250 but not over $171,050 Tell me Over $171,050 but not over $326,600 Over $326,600 but not over $414,700 Over $414,700 but not over $622,050 Over $622,050 4 Switch Windows TABLE 1-Section 1()(2)(A) - Married Individuals Filing Joint Returns Spouses 5 Macros The Tax Is: 10% of the taxable income $1,975 plus 12% of the excess over $19,750 $9,235 plus 22% of the excess over $80,250 $29,211 plus 24% of the excess over $171,050 $66,543 plus 32% of the excess over $326,600 $94,735 plus 35% of the excess over $414,700 $167,307.50 plus 37% of the excess over $622,050 Interest received in Private Banks Accounts $2.000 Jury Duty Compensation $3,000. Inheritanss. (Herencia recibida por Mrs. Lpez) $10,000 Interest in Milwaukee city bonds $1.500 Please mention in which form or schedule should be included the followings items: They have Salaries: Mr. Rivera $45,000 and Mr. Lopez $ 35,000 Interest received in Federal Bonds $1,000 6 [ Focus Share Comments + 87%

Step by Step Solution

There are 3 Steps involved in it

Here are the calculations and the formsschedules Calculations 1 Gross Income Gross Income Salaries I... View full answer

Get step-by-step solutions from verified subject matter experts