Answered step by step

Verified Expert Solution

Question

1 Approved Answer

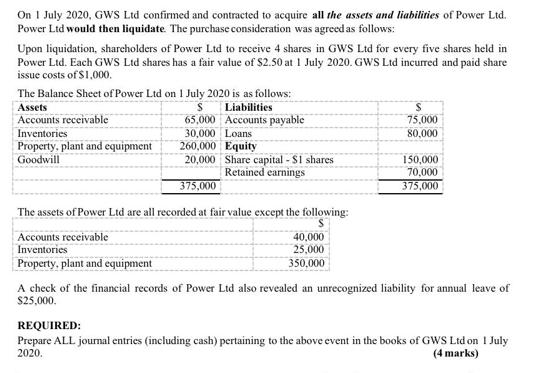

On 1 July 2020, GWS Ltd confirmed and contracted to acquire all the assets and liabilities of Power Ltd. Power Ltd would then liquidate.

On 1 July 2020, GWS Ltd confirmed and contracted to acquire all the assets and liabilities of Power Ltd. Power Ltd would then liquidate. The purchase consideration was agreed as follows: Upon liquidation, shareholders of Power Ltd to receive 4 shares in GWS Ltd for every five shares held in Power Ltd. Each GWS Ltd shares has a fair value of $2.50 at 1 July 2020. GWS Ltd incurred and paid share issue costs of $1,000. The Balance Sheet of Power Ltd on 1 July 2020 is as follows: Assets Liabilities Accounts receivable Accounts payable Inventories Property, plant and equipment Goodwill 65,000 30,000 Loans 260,000 Equity 20,000 Share capital - $1 shares Retained earnings 375,000 The assets of Power Ltd are all recorded at fair value except the following: S Accounts receivable Inventories Property, plant and equipment 40,000 25,000 350,000 75,000 80,000 150,000 70,000 375,000 A check of the financial records of Power Ltd also revealed an unrecognized liability for annual leave of $25,000. REQUIRED: Prepare ALL journal entries (including cash) pertaining to the above event in the books of GWS Ltd on 1 July 2020. (4 marks)

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To prepare the journal entries in the books of GWS Ltd on 1 July 2020 we need to consider t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started