Question

On January 1, 2022, Crane Corporation acquired machinery for $1710000. Crane adopted the straight-line method of depreciation for this machine and had been recording

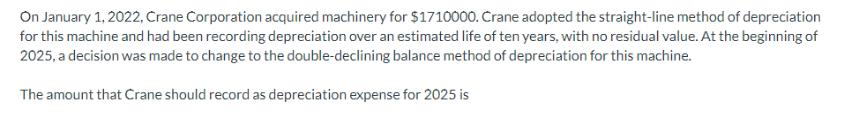

On January 1, 2022, Crane Corporation acquired machinery for $1710000. Crane adopted the straight-line method of depreciation for this machine and had been recording depreciation over an estimated life of ten years, with no residual value. At the beginning of 2025, a decision was made to change to the double-declining balance method of depreciation for this machine. The amount that Crane should record as depreciation expense for 2025 is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 1 To calculate the depreciation expense for 2025 when changing from straightline to doubledeclining balance DDB method follow these steps 1 Calculate the depreciation expense for 2022 2023 an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Accounting questions

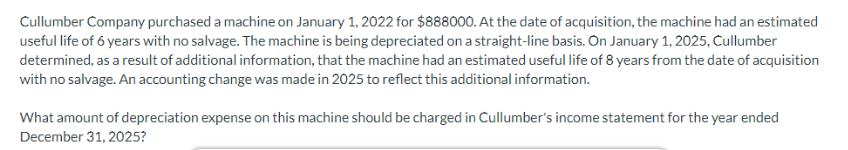

Question

Answered: 1 week ago

Question

Answered: 1 week ago

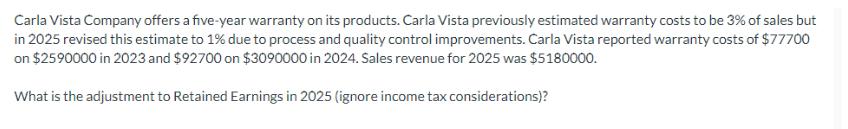

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App