Answered step by step

Verified Expert Solution

Question

1 Approved Answer

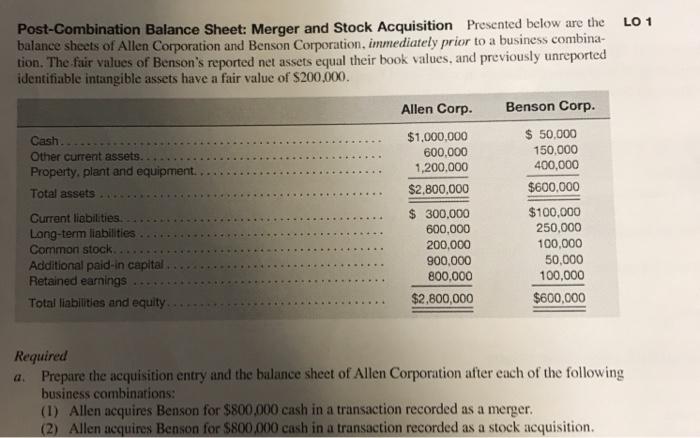

Post-Combination Balance Sheet: Merger and Stock Acquisition Presented below are the LO 1 balance sheets of Allen Corporation and Benson Corporation, immediately prior to

Post-Combination Balance Sheet: Merger and Stock Acquisition Presented below are the LO 1 balance sheets of Allen Corporation and Benson Corporation, immediately prior to a business combina- tion. The fair values of Benson's reported net assets equal their book values, and previously unreported identifiable intangible assets have a fair value of $200,000. Cash. Other current assets. Property, plant and equipment. Total assets. Current liabilities. Long-term liabilities Common stock. Additional paid-in capital. Retained earnings Total liabilities and equity. Allen Corp. $1,000,000 600,000 1,200,000 $2,800,000 $ 300,000 600,000 200,000 900,000 800,000 $2,800,000 Benson Corp. $ 50,000 150,000 400,000 $600,000 $100,000 250,000 100,000 50,000 100,000 $600,000 Required a. Prepare the acquisition entry and the balance sheet of Allen Corporation after each of the following business combinations: (1) Allen acquires Benson for $800,000 cash in a transaction recorded as a merger. (2) Allen acquires Benson for $800,000 cash in a transaction recorded as a stock acquisition.

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Solution a DateGeneral Journal Debit Cash 5000000 Other Current Assets 150000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started