Answered step by step

Verified Expert Solution

Question

1 Approved Answer

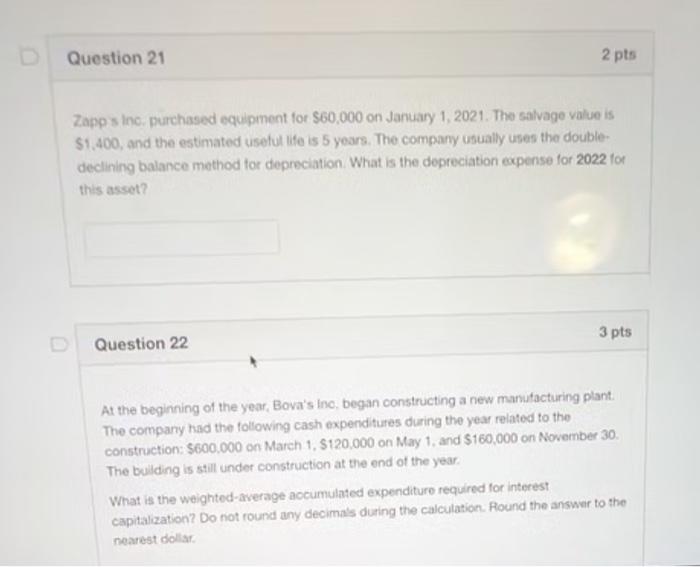

Question 21 2 pts Zapp's Inc. purchased equipment for $60,000 on January 1, 2021. The salvage value is $1,400, and the estimated useful life

Question 21 2 pts Zapp's Inc. purchased equipment for $60,000 on January 1, 2021. The salvage value is $1,400, and the estimated useful life is 5 years. The company usually uses the double- declining balance method for depreciation. What is the depreciation expense for 2022 for this asset? Question 22 3 pts At the beginning of the year, Bova's Inc, began constructing a new manufacturing plant The company had the following cash expenditures during the year related to the construction: $600,000 on March 1, $120,000 on May 1, and $160,000 on November 30. The building is still under construction at the end of the year. What is the weighted-average accumulated expenditure required for interest capitalization? Do not round any decimals during the calculation. Round the answer to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions in the image Question 21 Zapps Incuses the doubledeclining balance method for depreciationThe depreciation expense for 2022 is 11520 Question 22 The weightedavera...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started