Question

Question 4 1 pts This is a quick and easy bond question to warm up. A one-year discount bond promises to pay $96,750 dollars

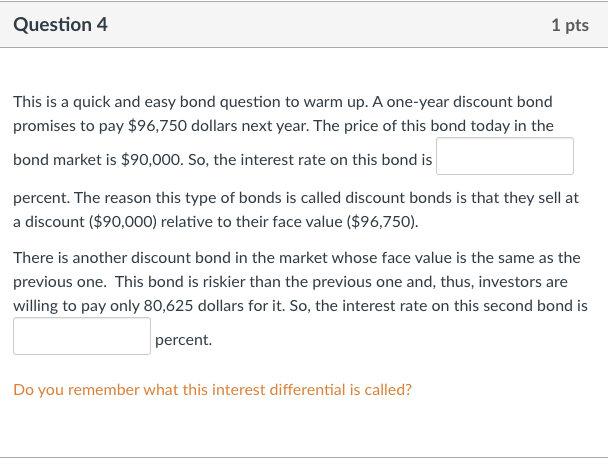

Question 4 1 pts This is a quick and easy bond question to warm up. A one-year discount bond promises to pay $96,750 dollars next year. The price of this bond today in the bond market is $90,000. So, the interest rate on this bond is percent. The reason this type of bonds is called discount bonds is that they sell at a discount ($90,000) relative to their face value ($96,750). There is another discount bond in the market whose face value is the same as the previous one. This bond is riskier than the previous one and, thus, investors are willing to pay only 80,625 dollars for it. So, the interest rate on this second bond is percent. Do you remember what this interest differential is called?

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The interest rate on the first bond can be calculated using the formula for discount bonds In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Strategic Management An Integrated Approach

Authors: Charles W. L. Hill, Gareth R. Jones

10th Edition

111182584X, 978-1111825843

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App