Question: Question 4 1 pts This is a quick and easy bond question to warm up. A one-year discount bond promises to pay $96,750 dollars

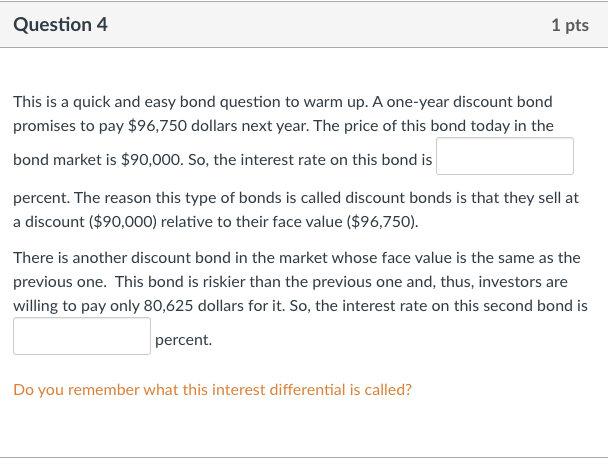

Question 4 1 pts This is a quick and easy bond question to warm up. A one-year discount bond promises to pay $96,750 dollars next year. The price of this bond today in the bond market is $90,000. So, the interest rate on this bond is percent. The reason this type of bonds is called discount bonds is that they sell at a discount ($90,000) relative to their face value ($96,750). There is another discount bond in the market whose face value is the same as the previous one. This bond is riskier than the previous one and, thus, investors are willing to pay only 80,625 dollars for it. So, the interest rate on this second bond is percent. Do you remember what this interest differential is called?

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

The interest rate on the first bond can be calculated using the formula for discount bonds In... View full answer

Get step-by-step solutions from verified subject matter experts