Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Richard and Smita have partnership capital account balances of $1062000 and $802000, respectively and share profits and losses equally. Sierra is admitted to the partnership

Richard and Smita have partnership capital account balances of $1062000 and $802000, respectively and share profits and losses equally. Sierra is admitted to the partnership by investing $446000 for a one-fourth ownership interest. The balance of Smita's Capital account after Sierra is admitted is?

Richard and Smita have partnership capital account balances of $1062000 and $802000, respectively and share profits and losses equally. Sierra is admitted to the partnership by investing $446000 for a one-fourth ownership interest. The balance of Smita's Capital account after Sierra is admitted is?The partnership agreement of James, Gise, and Bosco provides for the following income ratio: (a) James, the managing partner, receives a salary allowance of $107000, (b) each partner receives 15% interest on average capital investment, and (c) remaining net income or loss is divided equally. The average capital investments for the year were: James $590000, Gise $1100000, and Bosco $1700000. If partnership net income is $530000, the amount allocated to James should be?

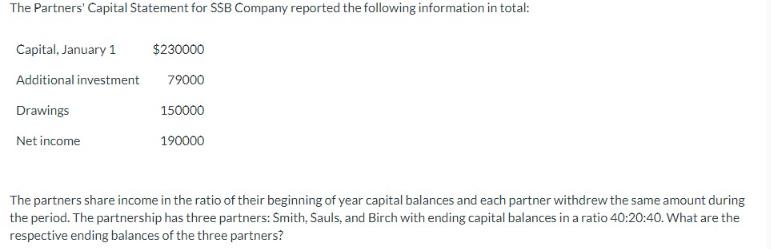

The Partners' Capital Statement for SSB Company reported the following information in total: Capital, January 1 Additional investment Drawings Net income $230000 79000 150000 190000 The partners share income in the ratio of their beginning of year capital balances and each partner withdrew the same amount during the period. The partnership has three partners: Smith, Sauls, and Birch with ending capital balances in a ratio 40:20:40. What are the respective ending balances of the three partners?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down each question 1 For SSB Company Capital January 1 230000 Additional investment 79000 Drawings 150000 Net income 190000 Ending capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started