Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Seven Sages, LLC made $400,000 is sales during the month of July, of which 30% constituted cash sales. The remaining amount were sales made

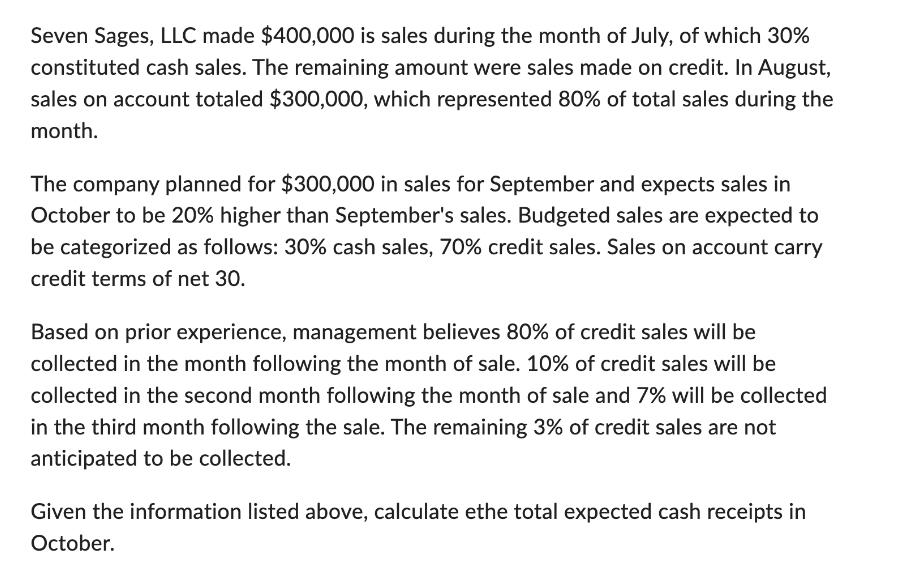

Seven Sages, LLC made $400,000 is sales during the month of July, of which 30% constituted cash sales. The remaining amount were sales made on credit. In August, sales on account totaled $300,000, which represented 80% of total sales during the month. The company planned for $300,000 in sales for September and expects sales in October to be 20% higher than September's sales. Budgeted sales are expected to be categorized as follows: 30% cash sales, 70% credit sales. Sales on account carry credit terms of net 30. Based on prior experience, management believes 80% of credit sales will be collected in the month following the month of sale. 10% of credit sales will be collected in the second month following the month of sale and 7% will be collected in the third month following the sale. The remaining 3% of credit sales are not anticipated to be collected. Given the information listed above, calculate ethe total expected cash receipts in October.

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the total expected cash receipts in October we need to consider the sales made in Septe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e5af738601_957602.pdf

180 KBs PDF File

663e5af738601_957602.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started