Question

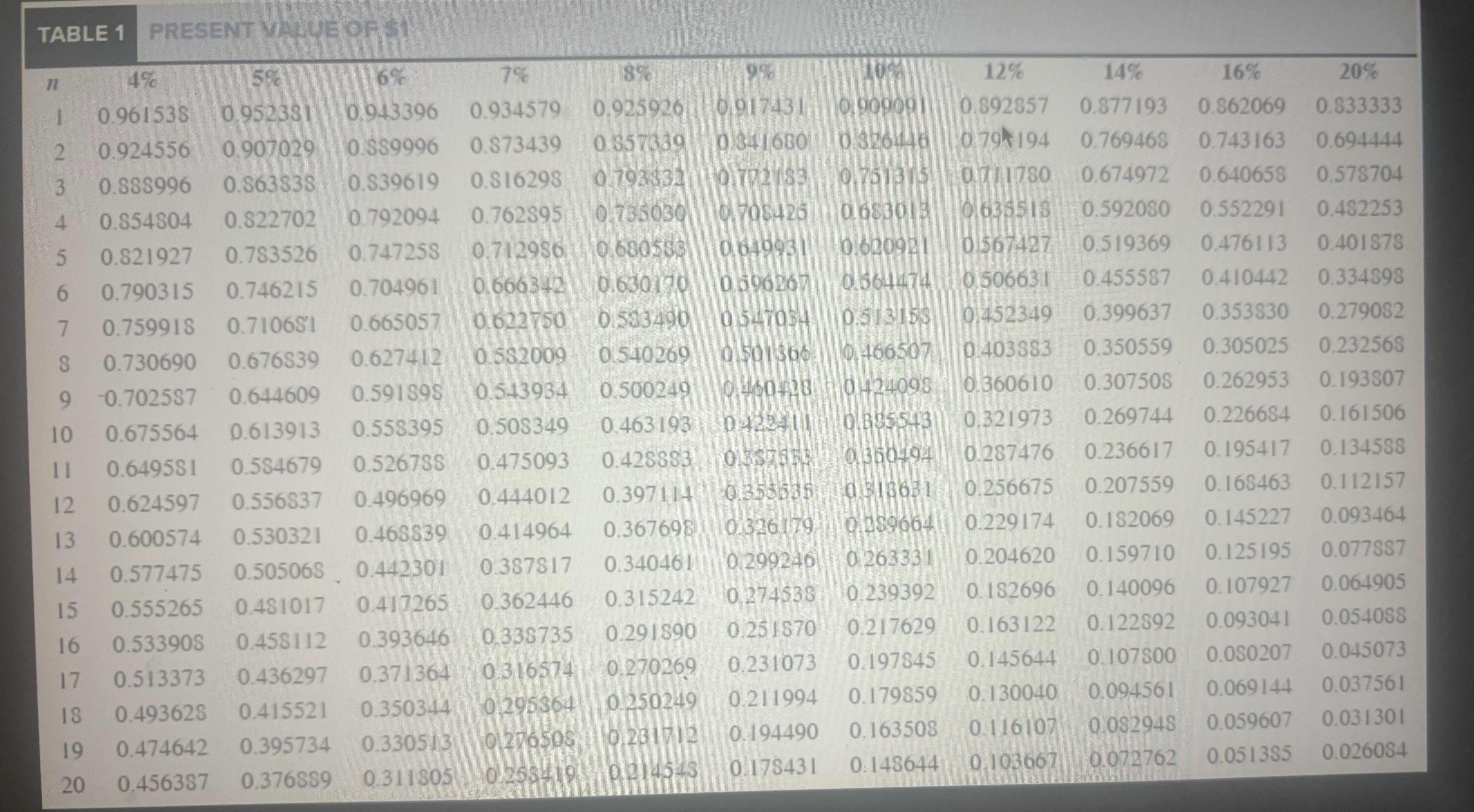

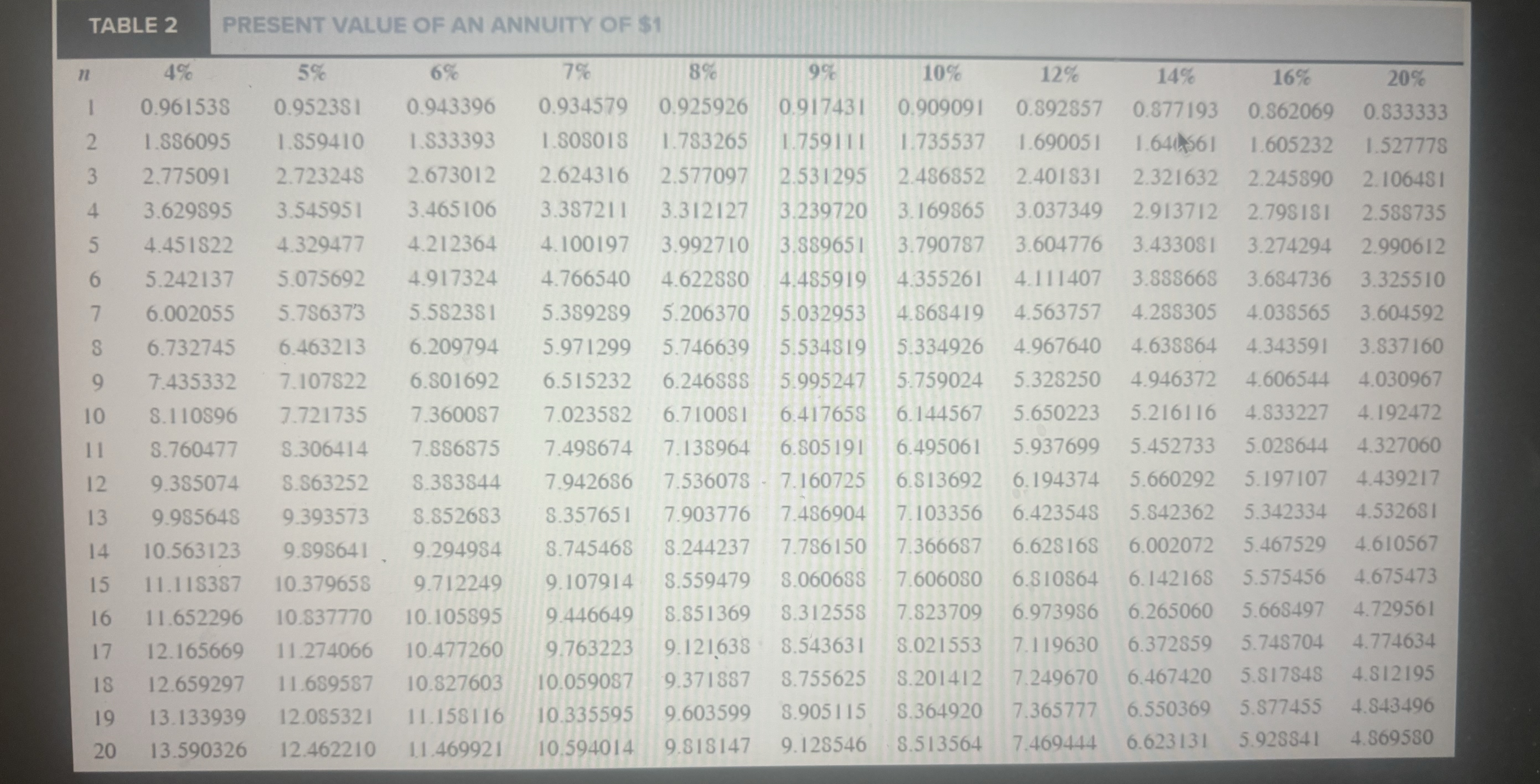

TABLE 1 PRESENT VALUE OF $1 11 5% 4% 0.952381 1 0.961538 0.907029 2 0.924556 0.863838 3 0.888996 4 0.854804 0.822702 6% 7% 0.943396

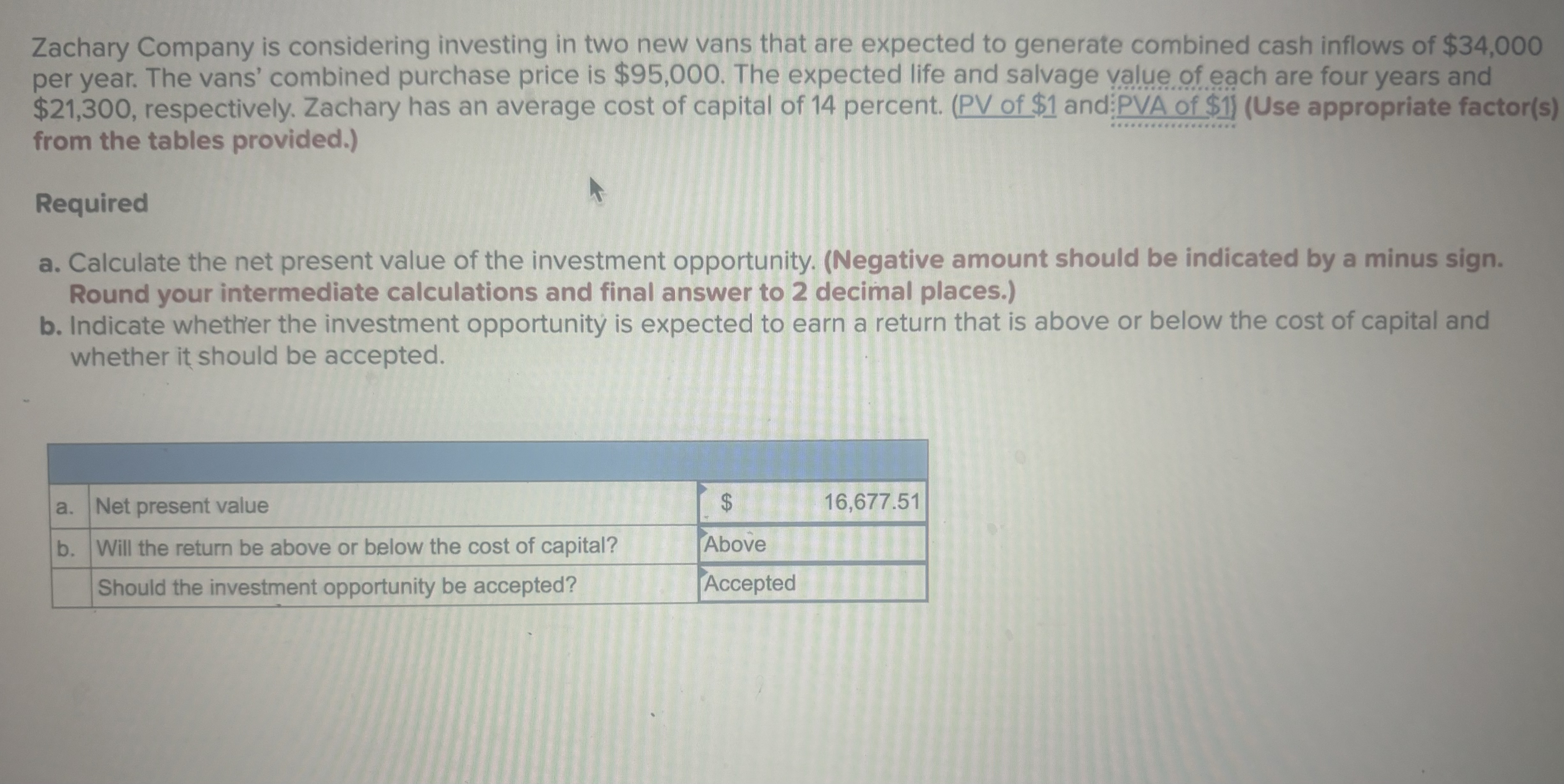

TABLE 1 PRESENT VALUE OF $1 11 5% 4% 0.952381 1 0.961538 0.907029 2 0.924556 0.863838 3 0.888996 4 0.854804 0.822702 6% 7% 0.943396 0.934579 0.889996 0.873439 0.839619 0.816298 5 0.792094 0.821927 0.783526 0.747258 6 0.790315 0.746215 0.762895 0.735030 0.712986 0.680583 0.704961 0.666342 0.630170 7 0.759918 0.710651 0.665057 0.622750 0.583490 8 0.730690 0.676839 9 -0.702587 0.644609 10 0.675564 0.613913 11 0.649581 0.584679 0.627412 0.582009 0.540269 0.591898 0.543934 0.500249 0.558395 0.508349 0.463193 0.526788 0.475093 12 0.624597 0.556837 0.496969 0.444012 8% 9% 10% 12% 14% 16% 20% 0.925926 0.917431 0.909091 0.892857 0.877193 0.862069 0.833333 0.857339 0.79 194 0.769468 0.743163 0.841680 0.826446 0.743163 0.694444 0.793832 0.711780 0.674972 0.640658 0.578704 0.772183 0.751315 0.708425 0.635518 0.683013 0.592080 0.552291 0.482253 0.649931 0.620921 0.567427 0.519369 0.476113 0.401878 0.596267 0.564474 0.506631 0.455587 0.410442 0.334898 0.547034 0.513158 0.452349 0.399637 0.353830 0.279082 0.501866 0.466507 0.350559 0.305025 0.232568 0.403883 0.460428 0.307508 0.262953 0.193807 0.424098 0.360610 0.269744 0.226684 0.161506 0.422411 0.385543 0.321973 0.428883 0.236617 0.195417 0.134588 0.387533 0.350494 0.287476 0.397114 0.318631 0.256675 0.207559 0.168463 0.112157 0.355535 0.367698 0.414964 0.326179 0.239664 0.229174 0.182069 0.145227 0.093464 13 0.600574 0.530321 0.468839 0.299246 0.263331 0.387817 0.340461 0.204620 0.159710 0.125195 0.077887 14 0.577475 0.505068 0.442301 0.315242 0.274538 0.239392 0.182696 0.140096 0.107927 0.064905 0.362446 15 0.555265 0.481017 0.417265 0.163122 0.251870 0.217629 0.122892 0.093041 0.054088 0.338735 0.393646 0.291890 16 0.533908 0.458112 0.107800 0.080207 0.045073 0.231073 0.197845 0.145644 0.270269 0.316574 0.436297 0.371364 17 0.513373 0.069144 0.037561 0.211994 0.179859 0.130040 0.094561 0.295864 0.250249 18 0.493628 0.415521 0.350344 0.082948 0.059607 0.031301 0.194490 0.163508 0.276508 0.231712 19 0.474642 0.395734 0.330513 0.178431 0:148644 20 0.456387 0.376889 0.311805 0.258419 0.214548 0.116107 0.103667 0.072762 0.051385 0.026084 TABLE 2 PRESENT VALUE OF AN ANNUITY OF $1 11 4% 5% 1 0.961538 0.952381 2 1.886095 1.859410 3 2.775091 2.723248 4 3.629895 3.545951 5 6 8 9 10 11 6% 7% 8% 9% 10% 12% 0.943396 0.934579 0.925926 0.917431 0.909091 0.892857 1.833393 1.808018 1.783265 1.759111 1.735537 1.690051 2.673012 2.624316 2.577097 2.531295 2.486852 2.401831 3.465106 3.387211 3.312127 3.239720 3.169865 3.037349 4.451822 4.329477 4.212364 5.242137 5.075692 4.917324 7 6.002055 5.786373 5.582381 6.732745 6.463213 6.209794 7.435332 7.107822 6.801692 8.110896 7.721735 7.360087 8.760477 8.306414 7.886875 12 9.385074 8.863252 8.383844 13 9.985648 9.393573 8.852683 14 10.563123 9.898641 9.294984 15 11.118387 10.379658 9.712249 16 11.652296 10.837770 10.105895 17 12.165669 11.274066 10.477260 18 12.659297 11.689587 10.827603 19 13.133939 12.085321 11.158116 20 13.590326 12.462210 1.1.469921 14% 0.877193 16% 20% 0.862069 0.833333 1.640 561 1.605232 1.527778 2.245890 2.106481 2.913712 2.798181 2.588735 4.100197 3.992710 3.889651 3.790787 3.604776 3.433081 3.274294 2.990612 4.766540 4.622880 4.485919 4.355261 4.111407 3.888668 3.684736 3.325510 5.389289 5.206370 5.032953 4.868419 4.563757 4.288305 4.038565 3.604592 5.971299 5.746639 5.534819 5.334926 4.967640 4.638864 4.343591 3.837160 6.515232 6.246888 5.995247 5.759024 5.328250 4.946372 4.606544 4.030967 7.023582 6.710081 6.417658 6.144567 5.650223 5.216116 4.833227 4.192472 7.498674 7.138964 6.805191 6.495061 5.937699 5.452733 5.028644 4.327060 7.942686 7.536078 7.160725 6.813692 6.194374 5.660292 5.197107 4.439217 8.357651 7.903776 7.486904 7.103356 6.423548 5.842362 5.342334 4.532681 8.745468 8.244237 7.786150 7.366687 6.628168 6.002072 5.467529 4.610567 9.107914 8.559479 8.060688 7.606080 6.810864 6.142168 5.575456 4.675473 9.446649 8.851369 8.312558 7.823709 6.973986 6.265060 5.668497 4.729561 9.763223 9.121638 8.543631 8.021553 7.119630 6.372859 5.748704 4.774634 10.059087 9.371887 8.755625 8.201412 7.249670 6.467420 5.817848 4.812195 10.335595 9.603599 8.905115 8.364920 7.365777 6.550369 5.877455 4.843496 10.594014 9.818147 9.128546 6.623131 5.928841 4.869580 8.513564 7.469444 2.321632 ****** Zachary Company is considering investing in two new vans that are expected to generate combined cash inflows of $34,000 per year. The vans' combined purchase price is $95,000. The expected life and salvage value of each are four years and $21,300, respectively. Zachary has an average cost of capital of 14 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a. Calculate the net present value of the investment opportunity. (Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answer to 2 decimal places.) b. Indicate whether the investment opportunity is expected to earn a return that is above or below the cost of capital and whether it should be accepted. a. Net present value $ 16,677.51 b. Will the return be above or below the cost of capital? Should the investment opportunity be accepted? Above Accepted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started