Answered step by step

Verified Expert Solution

Question

1 Approved Answer

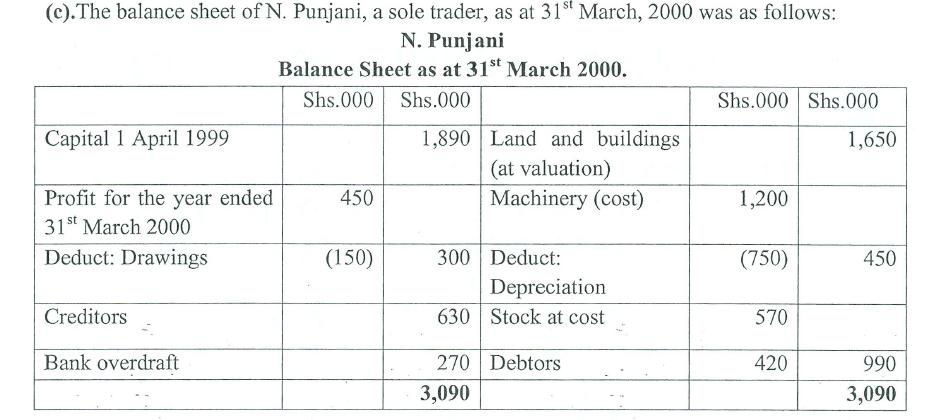

The balance sheet of N. Punjani, a sole trader, as at 31st March, 2000 was as follows: N. Punjani Balance Sheet as at 31st

The balance sheet of N. Punjani, a sole trader, as at 31st March, 2000 was as follows: N. Punjani Balance Sheet as at 31st March 2000. Shs.000 Shs.000 1,890 Capital 1 April 1999 Profit for the year ended 31st March 2000 Deduct: Drawings Creditors Bank overdraft 450 (150) Land and buildings (at valuation) Machinery (cost) 300 Deduct: Depreciation 630 Stock at cost 270 Debtors 3,090 Shs.000 Shs.000 1,200 (750) 570 420 1,650 450 990 3,090 Further investigations reveal the following information: 1. The closing stock includes damaged goods, which, although they had cost Shs. 10,000, have an estimated sale value of Shs. 7,500. 2. Debtors include Shs. 20,000 in respect of a customer who has gone bankrupt. A provision for doubtful debts of 2%2% is also required on the balance of the debtors. 3. The machinery was acquired five years ago and is being depreciated to its scrap value on a straight-line basis over eight years. A more realistic estimate indicates that the life span will be 10 years, 4. Wages owing at 31 March 2000 amounted to Shs. 9,500, but this has not been reflected in the accounts. 5. Charges for the bank overdraft, amounting to Shs. 8,000 have not been reflected in the - accounts. 6. In arriving at the profit for the period, a drawing of Shs. 100,000 paid to Mr. Punjani had been deducted as an expense. 7. Shs. 20,000 rents owing to Mr. Punjani for letting of part of his business premises to external party had not been received and no entry had been made in the books in respect of this item. Required: A statement of revised profit for the year ended 31 March 2000. (12 marks)

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below N Punjan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started