Question

The CFO of B-to-C Inc., a retailer of miscellaneous consumer products, recently announced the objective of paying its first (annual) cash dividend of $0.50

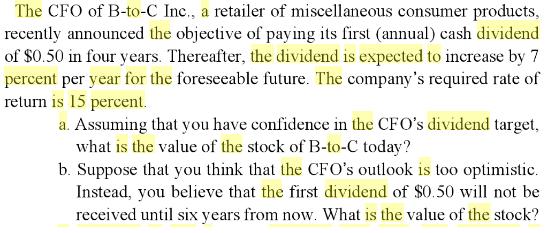

The CFO of B-to-C Inc., a retailer of miscellaneous consumer products, recently announced the objective of paying its first (annual) cash dividend of $0.50 in four years. Thereafter, the dividend is expected to increase by 7 percent per year for the foreseeable future. The company's required rate of return is 15 percent. a. Assuming that you have confidence in the CFO's dividend target, what is the value of the stock of B-to-C today? b. Suppose that you think that the CFO's outlook is too optimistic. Instead, you believe that the first dividend of $0.50 will not be received until six years from now. What is the value of the stock?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a to assess BtoC Inc stock value To calculate a stocks present value today we can use the Gordon Gro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Ethical Obligations And Decision Making In Accounting Text And Cases

Authors: Steven Mintz

6th Edition

1264135947, 9781264135943

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App