Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The economy in one year will be in either a boom or bust, with each economic state equally likely (i.e., 50% probability). Gravity Company

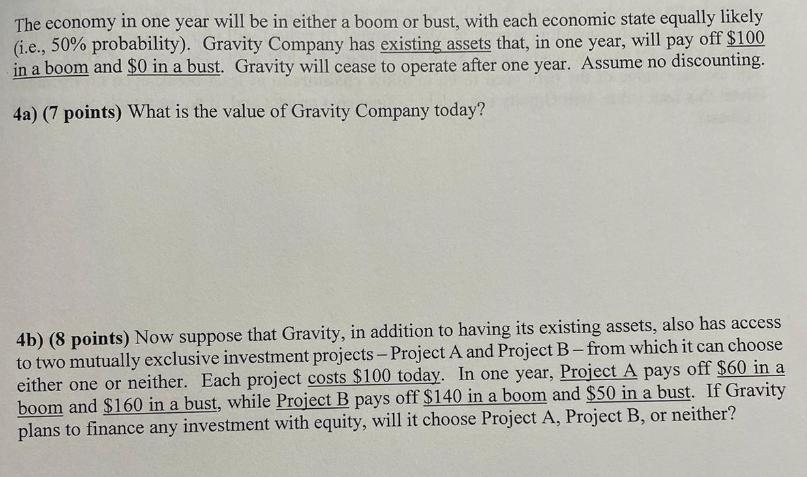

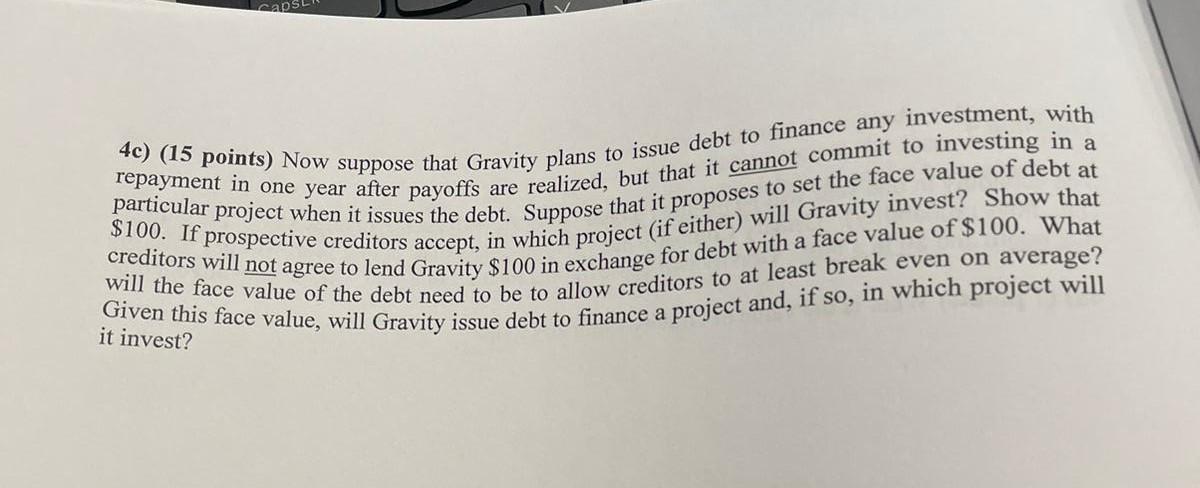

The economy in one year will be in either a boom or bust, with each economic state equally likely (i.e., 50% probability). Gravity Company has existing assets that, in one year, will pay off $100 in a boom and $0 in a bust. Gravity will cease to operate after one year. Assume no discounting. 4a) (7 points) What is the value of Gravity Company today? 4b) (8 points) Now suppose that Gravity, in addition to having its existing assets, also has access to two mutually exclusive investment projects - Project A and Project B- from which it can choose either one or neither. Each project costs $100 today. In one year, Project A pays off $60 in a boom and $160 in a bust, while Project B pays off $140 in a boom and $50 in a bust. If Gravity plans to finance any investment with equity, will it choose Project A, Project B, or neither? capst 4c) (15 points) Now suppose that Gravity plans to issue debt to finance any investment, with repayment in one year after payoffs are realized, but that it cannot commit to investing in a particular project when it issues the debt. Suppose that it proposes to set the face value of debt at $100. If prospective creditors accept, in which project (if either) will Gravity invest? Show that creditors will not agree to lend Gravity $100 in exchange for debt with a face value of $100. What will the face value of the debt need to be to allow creditors to at least break even on average? Given this face value, will Gravity issue debt to finance a project and, if so, in which project will it invest?

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

4a Value of Gravity Company today Without any investments Boom 100 existing assets Bust 0 existing a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started