Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The information regarding Parent Limited is as follows: Sandy Limited Parent acquired 65% of the outstanding ordinary shares of Sandy Limited for $700,000 on

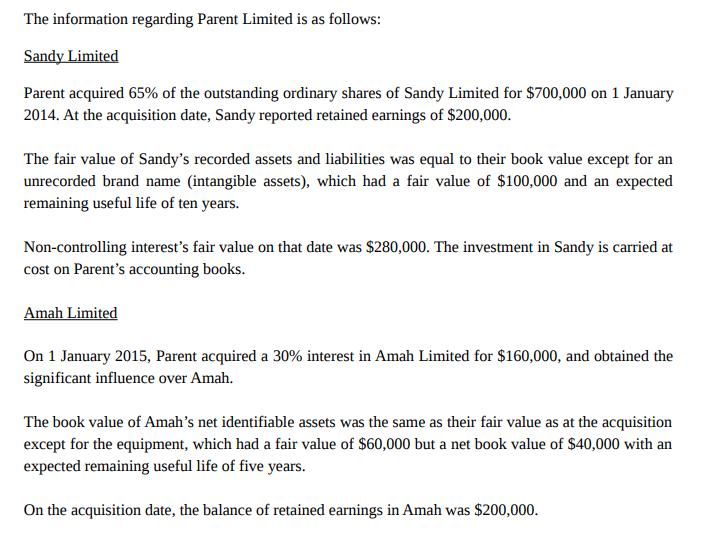

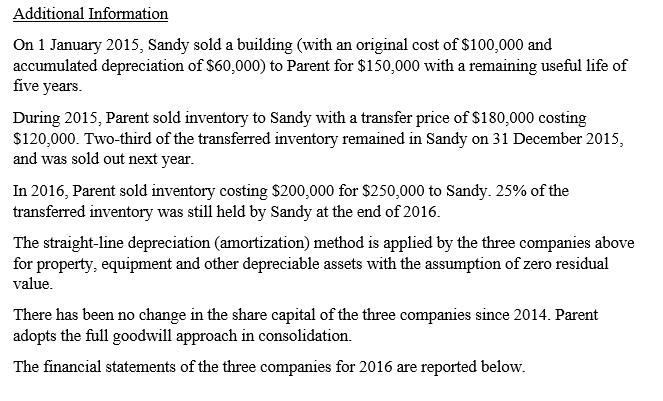

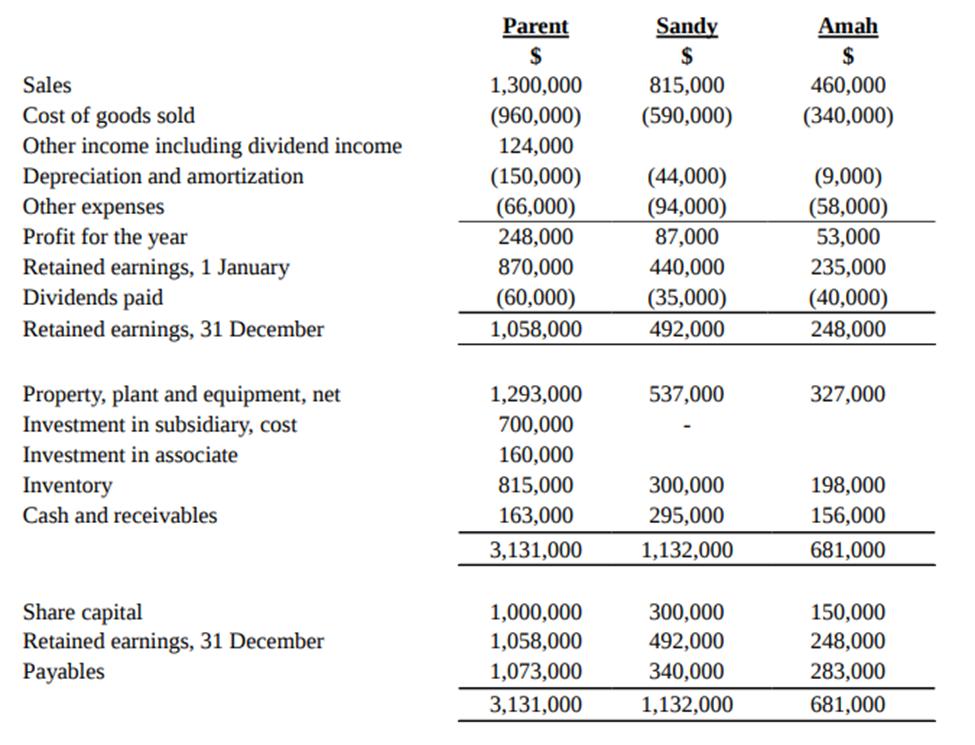

The information regarding Parent Limited is as follows: Sandy Limited Parent acquired 65% of the outstanding ordinary shares of Sandy Limited for $700,000 on 1 January 2014. At the acquisition date, Sandy reported retained earnings of $200,000. The fair value of Sandy's recorded assets and liabilities was equal to their book value except for an unrecorded brand name (intangible assets), which had a fair value of $100,000 and an expected remaining useful life of ten years. Non-controlling interest's fair value on that date was $280,000. The investment in Sandy is carried at cost on Parent's accounting books. Amah Limited On 1 January 2015, Parent acquired a 30% interest in Amah Limited for $160,000, and obtained the significant influence over Amah. The book value of Amah's net identifiable assets was the same as their fair value as at the acquisition except for the equipment, which had a fair value of $60,000 but a net book value of $40,000 with an expected remaining useful life of five years. On the acquisition date, the balance of retained earnings in Amah was $200,000. Additional Information On 1 January 2015, Sandy sold a building (with an original cost of $100,000 and accumulated depreciation of $60,000) to Parent for $150,000 with a remaining useful life of five years. During 2015, Parent sold inventory to Sandy with a transfer price of $180,000 costing $120,000. Two-third of the transferred inventory remained in Sandy on 31 December 2015, and was sold out next year. In 2016, Parent sold inventory costing $200,000 for $250,000 to Sandy. 25% of the transferred inventory was still held by Sandy at the end of 2016. The straight-line depreciation (amortization) method is applied by the three companies above for property, equipment and other depreciable assets with the assumption of zero residual value. There has been no change in the share capital of the three companies since 2014. Parent adopts the full goodwill approach in consolidation. The financial statements of the three companies for 2016 are reported below. Sales Cost of goods sold Other income including dividend income Depreciation and amortization Other expenses Profit for the year Retained earnings, 1 January Dividends paid Retained earnings, 31 December Property, plant and equipment, net Investment in subsidiary, cost Investment in associate Inventory Cash and receivables Share capital Retained earnings, 31 December Payables Parent $ 1,300,000 (960,000) 124,000 (150,000) (66,000) 248,000 870,000 (60,000) 1,058,000 1,293,000 700,000 160,000 815,000 163,000 3,131,000 1,000,000 1,058,000 1,073,000 3,131,000 Sandy $ 815,000 (590,000) (44,000) (94,000) 87,000 440,000 (35,000) 492,000 537,000 300,000 295,000 1,132,000 300,000 492,000 340,000 1,132,000 Amah $ 460,000 (340,000) (9,000) (58,000) 53,000 235,000 (40,000) 248,000 327,000 198,000 156,000 681,000 150,000 248,000 283,000 681,000 Required (ignore taxation): Prepare the consolidation worksheet for the year ended 31 December 2016 for Parent Limited by using the worksheet in the answer booklet.

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started