Answered step by step

Verified Expert Solution

Question

1 Approved Answer

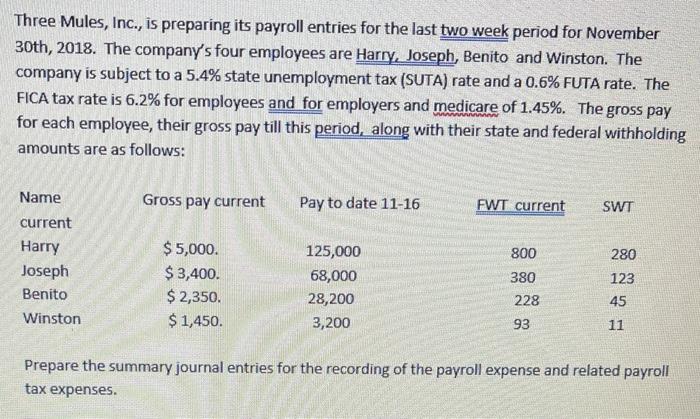

Three Mules, Inc., is preparing its payroll entries for the last two week period for November 30th, 2018. The company's four employees are Harry,

Three Mules, Inc., is preparing its payroll entries for the last two week period for November 30th, 2018. The company's four employees are Harry, Joseph, Benito and Winston. The company is subject to a 5.4% state unemployment tax (SUTA) rate and a 0.6% FUTA rate. The FICA tax rate is 6.2% for employees and for employers and medicare of 1.45%. The gross pay for each employee, their gross pay till this period, along with their state and federal withholding amounts are as follows: Name current Harry Joseph Benito Winston Gross pay current $ 5,000. $ 3,400. $ 2,350. $ 1,450. Pay to date 11-16 125,000 68,000 28,200 3,200 FWT current 800 380 228 93 SWT 280 123 45 11 Prepare the summary journal entries for the recording of the payroll expense and related payroll tax expenses.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Description Nov30 Payroll Expense Ac Date Journal Entries To Payroll Payab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started