Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Today is the morning of Jan 2, Year 5. XYZ Inc has exchange-listed convertible bonds outstanding. The coupon rate is 9.79% with the coupon

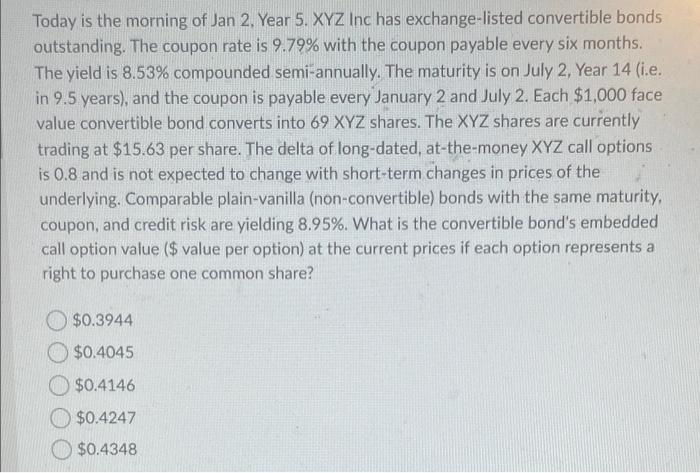

Today is the morning of Jan 2, Year 5. XYZ Inc has exchange-listed convertible bonds outstanding. The coupon rate is 9.79% with the coupon payable every six months. The yield is 8.53% compounded semi-annually. The maturity is on July 2, Year 14 (i.e. in 9.5 years), and the coupon is payable every January 2 and July 2. Each $1,000 face value convertible bond converts into 69 XYZ shares. The XYZ shares are currently trading at $15.63 per share. The delta of long-dated, at-the-money XYZ call options is 0.8 and is not expected to change with short-term changes in prices of the underlying. Comparable plain-vanilla (non-convertible) bonds with the same maturity, coupon, and credit risk are yielding 8.95%. What is the convertible bond's embedded call option value ($ value per option) at the current prices if each option represents a right to purchase one common share? $0.3944 $0.4045 O $0.4146 $0.4247 $0.4348

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Page 1 0 394 Solution Amounts Optem A o 3944 Tota...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started