Question

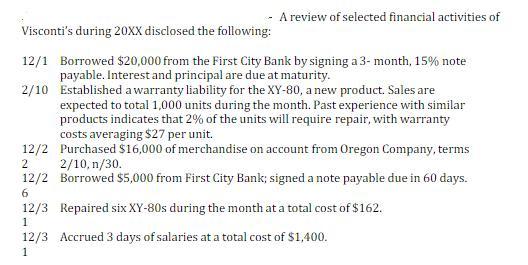

Visconti's during 20XX disclosed the following: 12/1 Borrowed $20,000 from the First City Bank by signing a 3-month, 15% note payable. Interest and principal

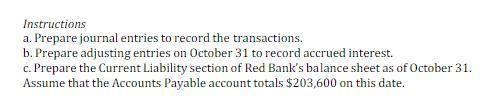

Visconti's during 20XX disclosed the following: 12/1 Borrowed $20,000 from the First City Bank by signing a 3-month, 15% note payable. Interest and principal are due at maturity. 2/10 Established a warranty liability for the XY-80, a new product. Sales are expected to total 1,000 units during the month. Past experience with similar products indicates that 2% of the units will require repair, with warranty costs averaging $27 per unit. Purchased $16,000 of merchandise on account from Oregon Company, terms 2/10, n/30. Borrowed $5,000 from First City Bank; signed a note payable due in 60 days. Repaired six XY-80s during the month at a total cost of $162. Accrued 3 days of salaries at a total cost of $1,400. 12/2 2 12/2 6 12/3 1 - A review of selected financial activities of 12/3 1 Instructions a. Prepare journal entries to record the transactions. b. Prepare adjusting entries on October 31 to record accrued interest. c. Prepare the Current Liability section of Red Bank's balance sheet as of October 31. Assume that the Accounts Payable account totals $203,600 on this date.

Step by Step Solution

3.40 Rating (134 Votes )

There are 3 Steps involved in it

Step: 1

a JOURNAL Date Account Titles and Explanation Debit Credit 121 Cash 2000...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started