Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You invest $1 today in the stock market. The return or percentage growth of the stock market is 6% per year. After 25 years,

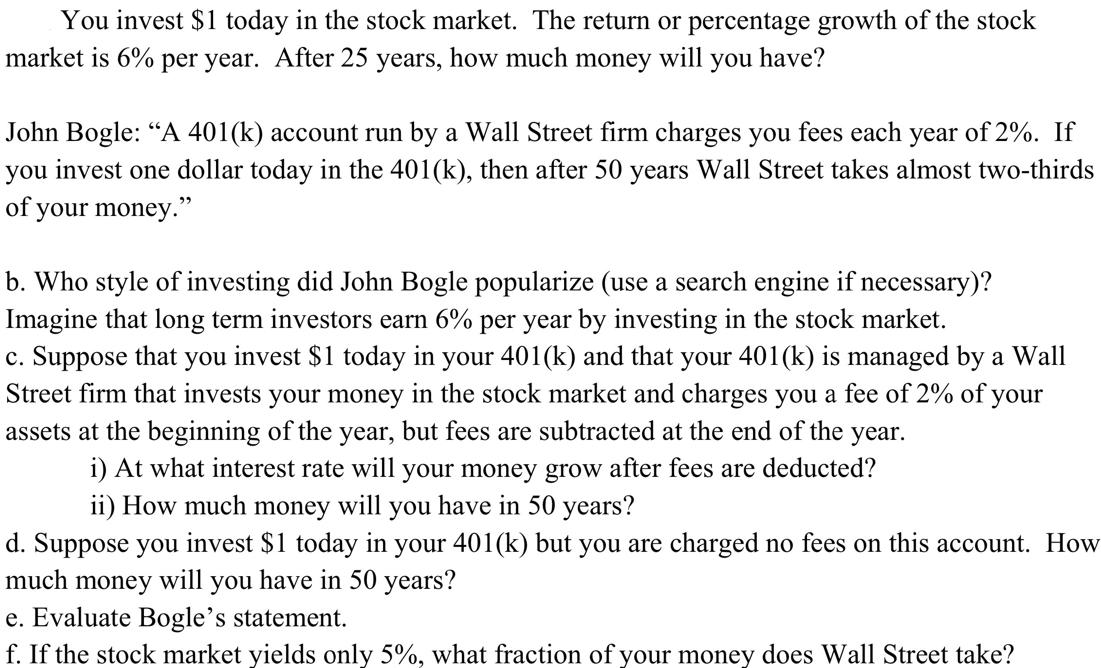

You invest $1 today in the stock market. The return or percentage growth of the stock market is 6% per year. After 25 years, how much money will you have? John Bogle: "A 401(k) account run by a Wall Street firm charges you fees each year of 2%. If you invest one dollar today in the 401(k), then after 50 years Wall Street takes almost two-thirds of your money." b. Who style of investing did John Bogle popularize (use a search engine if necessary)? Imagine that long term investors earn 6% per year by investing in the stock market. c. Suppose that you invest $1 today in your 401(k) and that your 401(k) is managed by a Wall Street firm that invests your money in the stock market and charges you a fee of 2% of your assets at the beginning of the year, but fees are subtracted at the end of the year. i) At what interest rate will your money grow after fees are deducted? ii) How much money will you have in 50 years? d. Suppose you invest $1 today in your 401(k) but you are charged no fees on this account. How much money will have in 50 years? you e. Evaluate Bogle's statement. f. If the stock market yields only 5%, what fraction of your money does Wall Street take?

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a John Bogle popularized the style of investing called index investing Index investing is a passive ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started