Blue Corporation, a manufacturing company, decided to develop a new line of merchandise. The project began in

Question:

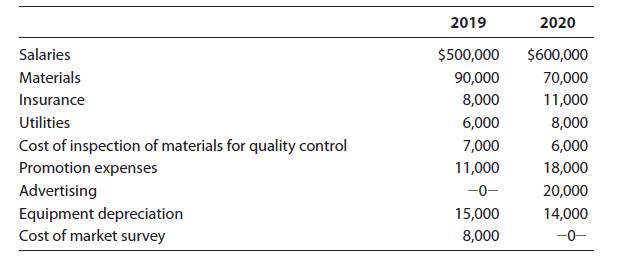

Blue Corporation, a manufacturing company, decided to develop a new line of merchandise. The project began in 2019. Blue had the following expenses in connection with the project:

The new product will be introduced for sale beginning in April 2021. Determine the amount of the deduction for research and experimental expenditures for 2019, 2020, 2021, and 2022 if:

a. Blue Corporation elects to expense the research and experimental expenditures.

b. Blue Corporation elects to amortize the research and experimental expenditures over 60 months.

c. How would your answer change if Blue Corporation incurred the expenses in 2022 and 2023 (rather than 2019 and 2020)?

Step by Step Answer:

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young