Jordan Johnson is single and has adjusted gross income of $50,000 in the current year. Additional information

Question:

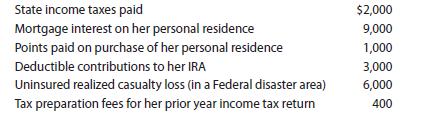

Jordan Johnson is single and has adjusted gross income of $50,000 in the current year. Additional information is as follows:

What amount may Jordan claim as itemized deductions on her current-year income tax return?

a. $12,000

b. $12,900

c. $13,300

d. $15,900

Transcribed Image Text:

State income taxes paid Mortgage interest on her personal residence Points paid on purchase of her personal residence Deductible contributions to her IRA Uninsured realized casualty loss (in a Federal disaster area) Tax preparation fees for her prior year income tax return $2,000 9,000 1,000 3,000 6,000 400

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Choice b is correct 12900 of itemized deductions for the current year calculated as follows Note The ...View the full answer

Answered By

YOGENDRA NAILWAL

As I'm a Ph.D. student, so I'm more focussed on my chemistry laboratory. I have qualified two national level exams viz, GATE, and NET JRF (Rank 68). So I'm highly qualified in chemistry subject. Also, I have two years of teaching experience in this subject, which includes college teacher as well as a personal tutor. I can assure you if you hire me on this particular subject, you are never going to regret it.

Best Regards.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Jordan Johnson is single and has adjusted gross income of $50,000 in the current year. Additional information is as follows: State income taxes...

-

Calvin reviewed his cancelled checks and receipts this year for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005....

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

In Problems 2738, the reduced row echelon form of a system of linear equations is given. Write the system of equations corresponding to the given matrix. Use x, y; or x, y, z; or x 1 , x 2 , x 3 , x...

-

Review the temporal event checklist in Figure. Would a student grade report be an internal or external output? Would a class list for the instructor be an internal or external output? What are some...

-

Contrast serial bonds and bonds requiring a sinking fund.

-

Explain the difference between consent and informed consent.

-

Alan Industries is expanding its product line to include three new products: A, B, and C. These are to be produced on the same production equipment, and the objective is to meet the demands for the...

-

A couple obtained a $20,000 mortgage loan at an interest rate of 10.5% compounded monthly. (Original principal equals to PV of all payments discounted at the interest rate on the loan contract) (1)...

-

Ambers employer, Lavender, Inc., uses a 401(k) plan that permits salary deferral elections by its employees. Ambers salary is $99,000, her marginal tax rate is 24%, and she is 42 years old. a. What...

-

Christine is a full-time fourth-grade teacher at Vireo Academy. During 2022, she spends $1,400 for classroom supplies. On the submission of adequate substantiation, Vireo reimburses her for $500 of...

-

Data for Brecker Inc. are presented in E23.13. Brecker Inc., a greeting card company, had the following statements prepared as of December 31, 2020. Instructions Prepare a statement of cash flows...

-

Widely known as an ethical company, Dell recently committed itself to becoming a more environmentally sustainable business. After reviewing the About Dell section of its website...

-

Most everyone is familiar with Angry Birds, the video game in which players use a slingshot to launch birds at pigs stationed on or within various structures. The goal is to destroy all the pigs on...

-

Are benchmarking data available in the simulation exercise in which you are participating? If so, do you and your co-managers regularly study the benchmarking data to see how well your company is...

-

If a new product or service seems like the perfect option to solve a problem or capitalize on an environmental trend, but its customers find out it cant deliver on its promises, they will quickly...

-

Assume you are in charge of developing the strategy for an international company selling products in some 50 different countries around the world. One of the issues you face is whether to employ a...

-

Determine the future value (FV) at the end of two years of an investment of $3,000 made now and an additional $3,000 made one year from now if the compound annual interest rate is 4 percent.

-

A simple random sample of 220 university students were asked what pasta they usually order and with which sauce. The preferences of these respondents are summarised below: Sauce Bolognese Pasta...

-

Continue with the facts of Question 4. Cheap Phones, one of Josie's customers who is facing tight cash flow problems, wants to return about 100 defective cell phones. Talk2Me tells Josie to bring the...

-

Continue with the facts of Question 4. Cheap Phones, one of Josie's customers who is facing tight cash flow problems, wants to return about 100 defective cell phones. Talk2Me tells Josie to bring the...

-

Marcella (a calendar year taxpayer) purchased a sculpture for $5,000. When the sculpture is worth $12,000 (as later determined by the IRS), Marcella donates it to the Peoria Museum of Art, a public...

-

John Ltd. is discussing new ways to recapitalize the firm and raise additional capital. Its current capital structure has a 30% weight in ordinary equity, 10% in preferred stock, and 60% in debt. The...

-

Sarah is self-employed. On January 15, she borrowed $10,000 at 5 percent annual interest for the purpose of purchasing equipment for her business. The funds were credited directly into her checking...

-

Tony Inc. has the information shown days? on its annual Income Statement and Balance Sheet. What is the firm's cash conversion cycle in [Type only the final answer into the response box below (NOT...

Study smarter with the SolutionInn App