Lyon, a cash basis taxpayer, died on January 15 of the current year. During the current year,

Question:

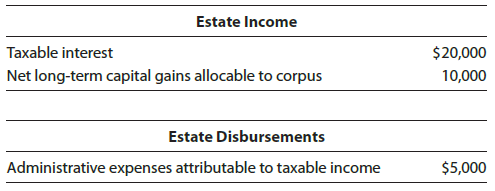

Lyon, a cash basis taxpayer, died on January 15 of the current year. During the current year, the estate executor made the required periodic distribution of $9,000 from estate income to Lyon?s sole heir. The following information pertains to the estate?s income and disbursements for the year. For the current calendar year, what was the estate?s distributable net income (DNI)?

a. $15,000

b. $20,000

c. $25,000

d. $30,000

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2020 Comprehensive

ISBN: 9780357109144

43rd Edition

Authors: David M. Maloney, William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

Question Posted: