Parker and his wife Marie would have been filing a joint tax return for 20X1, however Marie

Question:

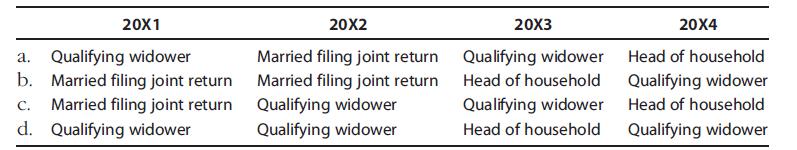

Parker and his wife Marie would have been filing a joint tax return for 20X1, however Marie died in October of 20X1. Parker has not remarried and continues to maintain a home for himself and his two children during 20X1, 20X2, 20X3, and 20X4. Parker’s filing statuses for 20X1, 20X2, 20X3, and 20X4 are as follows:

Transcribed Image Text:

20X1 a. Qualifying widower b. Married filing joint return C. Married filing joint return d. Qualifying widower 20X2 Married filing joint return Married filing joint return Qualifying widower Qualifying widower 20X3 Qualifying widower Head of household Qualifying widower Head of household 20X4 Head of household Qualifying widower Head of household Qualifying widower

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

Based on the information provided here are Parkers filing statuses for the ...View the full answer

Answered By

Abdul Wahab Qaiser

Before working at Mariakani, I volunteered at a local community center, where I tutored students from diverse backgrounds. I helped them improve their academic performance and develop self-esteem and confidence. I used creative teaching methods, such as role-playing and group discussions, to make the learning experience more engaging and enjoyable.

In addition, I have conducted workshops and training sessions for educators and mental health professionals on various topics related to counseling and psychology. I have presented research papers at conferences and published articles in academic journals.

Overall, I am passionate about sharing my knowledge and helping others achieve their goals. I believe that tutoring is an excellent way to make a positive impact on people's lives, and I am committed to providing high-quality, personalized instruction to my students.

0.00

0 Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2016 Individual Income Taxes

ISBN: 9781305393301

39th Edition

Authors: James H. Boyd, William H. Jr. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Parker and his wife Marie would have been filing a joint tax return for 2016; however, Marie died in October 2016. Parker has not remarried and continues to maintain a home for himself and his two...

-

Parker and his wife Marie would have been filing a joint tax return for 2014, however Marie died in October 2014. Parker has not remarried and continues to maintain a home for himself and his two...

-

Multiple Choice Questions 1. Keller is a single individual who in 2016 qualified for a foreign earned income exclusion of $80,000. Keller's 2016 net investment income was $25,000, and Keller's 2016...

-

The adjusted trial balance of Silver Sign Company follows: Requirements 1. Assume Silver Sign Company has a January 31 year end. Journalize Silvers closing entries at January 31. 2. How much net...

-

Eastern Pacific Company sells a single product for $34 per unit. If variable expenses are 65% of sales and fixed expenses total $12,800, the break-even point in quantity and dollar ($) will be?

-

Asaya Clothing Inc. is a manufacturer of winter clothes. It has a Knitting department and a Finishing department. This exercise focuses on the Finishing department. Direct materials are added at the...

-

Provide examples for composite and collection objects. How do they differ?

-

On October 29, 2010, Lue Co. began operations by purchasing razors for resale. Lue uses the perpetual inventory method. The razors have a 90-day warranty that requires the company to replace any...

-

a ) Three 0 . 3 0 0 - kg billiard balls are placed on a table at the corners of a right triangle, as shown in photo. Find the net gravitational force on the cue ball ( designated as m 1 ) resulting...

-

The table shows the number of TVs sold by a major retailer in California for three years. (a) Use Excel to prepare a 2-D side-byside column chart with screen size on the horizontal axis. (b) Change...

-

Mark and Lisa were divorced in 2014. In 2015, Mark has custody of their children, but Lisa provides nearly all of their support. Who is entitled to claim the children as dependents?

-

In late 2015, the Polks come to you for tax advice. They are considering selling some stock investments for a loss and making a contribution to a traditional IRA. In reviewing their situation, you...

-

Show that the product of two complex numbers (a + jb) and (c + jd) can be performed with three real multiplication and five additions using the algorithm xR = (a b)d + (c d)a x1 = (a b)d + (c +...

-

A bank records the number of mortgage applications and its own prevailing interest rate (at the first of the month) for each of 16 consecutive months. Is there a correlation between the interest rate...

-

Consider the simple network in Figure 3.54, in which A and B exchange distance-vector routing information. All links have cost 1. Suppose the AE link fails. (a) Give a sequence of routing table...

-

In Problems 25-40, decide on a reasonable means for conducting the survey to obtain the desired information. Suppose the city wants to sample people from a long street that starts in the poor area...

-

Probability sampling assumes that every unit in the population has a positive chance of being selected in the sample, and that this probability can be accurately determined. Some types of probability...

-

Compare and contrast mean, median, and mode.

-

The following financial information was taken from the books of Serenity Spa: Account Balances as of December 31, 2016 Accounts Receivable ....... $ 54,000 Accounts Payable ........ 15,000...

-

The company manufactures three products: wooden chairs, tables and dressers. AFC started off as a 'Mom & Pop' shop but has grown rapidly. AFC uses one assembly line to build all three products,...

-

Hummingbird Corporation, a closely held C corporation that is not a PSC, has $40,000 of net active income, $15,000 of portfolio income, and a $45,000 loss from a passive activity. Compute...

-

Hummingbird Corporation, a closely held C corporation that is not a PSC, has $40,000 of net active income, $15,000 of portfolio income, and a $45,000 loss from a passive activity. Compute...

-

Hummingbird Corporation, a closely held C corporation that is not a PSC, has $40,000 of net active income, $15,000 of portfolio income, and a $45,000 loss from a passive activity. Compute...

-

Statement of retained earnings Hayes Enterprises began 2019 with a retained earnings balance of $922,000. During 2019, the firm earned $386,000 after taxes. From this amount, preferred stockholders...

-

What methods might lerra Lycos use to measure the effectiveness of the various Web sites of its affiliates and subsidiaries ?"

-

Oriole International Inc. of Montreal has supported a research and development (R&D) department that for many years has been the sole contributor to the company's new products. The R&D activity is an...

Study smarter with the SolutionInn App