Redo questions 52 and 53, using J&Js return on assets. Question 52 Use your results from the

Question:

Redo questions 52 and 53, using J&J’s return on assets.

Question 52

Use your results from the regression given in question 65 of Chap. 13 to test the significance of b via a t-test. Also construct a 90 % confidence interval for b.

Question 65 of Chap. 13

Use the data given in question 24 of Chap. 2 to estimate the regression coefficients for a regression of J&J’s current ratio on the pharmaceutical industry’s current ratio.

Question 24 of Chap. 2

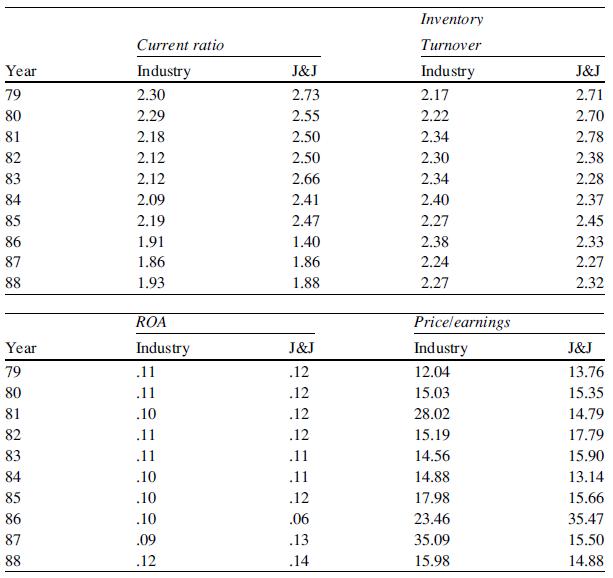

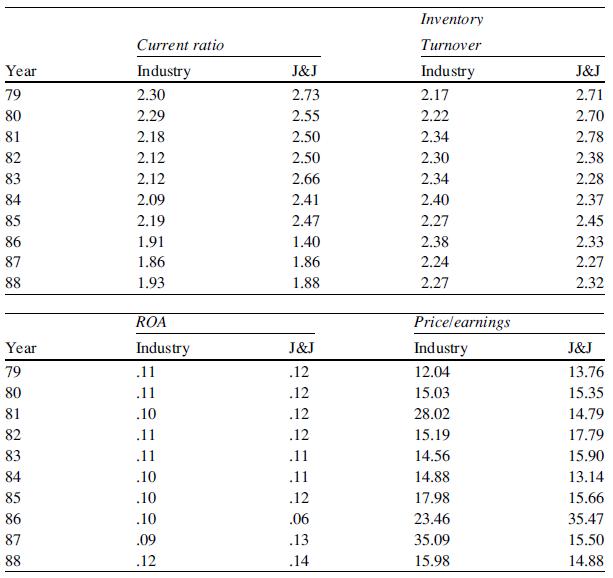

You are given the following financial ratios for Johnson & Johnson and for the pharmaceutical industry:

Question 53

Again using your results from question 65 of Chap. 13, forecast the value of J&J’s current ratio. Assume that the best forecast of the industry’s current ratio is the mean of that ratio. Construct a 99 % confidence interval for this forecast.

Question 65 of Chap. 13

Use the data given in question 24 of Chap. 2 to estimate the regression coefficients for a regression of J&J’s current ratio on the pharmaceutical industry’s current ratio.

Question 24 of Chap. 2

You are given the following financial ratios for Johnson & Johnson and for the pharmaceutical industry:

Step by Step Answer:

Statistics For Business And Financial Economics

ISBN: 9781461458975

3rd Edition

Authors: Cheng Few Lee , John C Lee , Alice C Lee