Ewan began trading on 1 April 2020. A brief summary of his income statement for the year

Question:

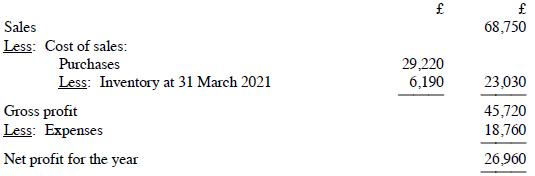

Ewan began trading on 1 April 2020. A brief summary of his income statement for the year to 31 March 2021 (prepared on the accruals basis) is as follows:

Notes:

1. Trade receivables at 31 March 2021 were £5,840. Trade payables were £3,650.

Accrued expenses were £830 and prepaid expenses were £310.

2. The expenses include motoring costs of £3,120 and loan interest of £600. There were no accruals or prepayments in relation to either of these expenses at the year end.

Ewan drove 12,400 business miles during the year.

3. Equipment costing £4,500 (useful life five years) and a motor car costing £14,200 were bought in April 2020. Depreciation of £900 and £3,550 respectively on these items is included in expenses.

Calculate Ewan's trading profit for tax purposes, on the assumption that he decides to use the cash basis and claims a fixed rate deduction in relation to his motor expenses.

Step by Step Answer: