Imran owns a business which operates from rented premises. He has a 10-year lease on the premises

Question:

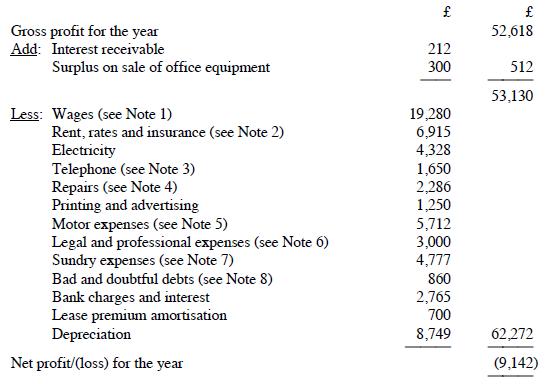

Imran owns a business which operates from rented premises. He has a 10-year lease on the premises and he paid a premium of £7,000 on 1 January 2020 in order to renew this lease. His income statement for the year to 31 December 2020 is as follows:

Notes:

1. Wages include £5,800 for Imran's wife (who works part-time for the business) and £1,000 for his son (a student who does not work for the business at all). Also included in wages are Imran's personal income tax and personal National Insurance contributions totalling £3,524.

2. Insurance includes Imran's private medical insurance premium of £405.

3. It has been agreed that one-sixth of telephone costs relate to private use.

4. Repairs include £750 for the cost of essential repairs to a newly-acquired secondhand forklift truck which could not be used until the repairs had been carried out.

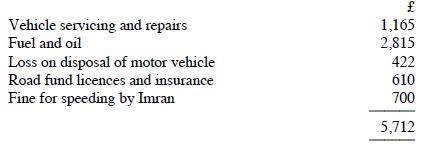

5. Motor expenses are as follows:

It has been agreed that one-tenth of motor expenses relate to private use.

6. Legal and professional expenses comprise legal fees of £850 (on renewal of Imran's 10-year lease), debt collection fees of £1,250 and accountancy fees of £900.

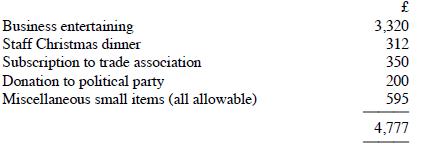

7. Sundry expenses are:

8. Trade debts of £500 were written off during the year. The general allowance for doubtful debts was reduced by £100 and the specific allowance for doubtful debts was increased by £460.

9. During the year, Imran appropriated trading stock costing £220 from the business for personal use, paying £220 of his own money into the business bank account. His gross profit percentage on turnover is 20%.

Compute Imran's trading profit (before deduction of capital allowances) for the year to 31 December 2020.

Step by Step Answer: