Q Ltd prepares accounts to 31 March each year. The company made the following two disposals of

Question:

Q Ltd prepares accounts to 31 March each year. The company made the following two disposals of chargeable assets during the year to 31 March 2021:

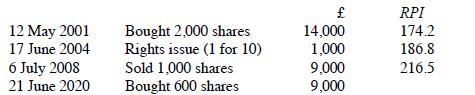

(1) 1,250 shares in Hentic Ltd were sold on 28 June 2020 for £25,000. Previous purchases and sales of shares in Hentic Ltd had been as follows:

(2) The company's factory was sold for £437,500 on 4 March 2021. This factory had been purchased on 11 April 2002 (RPI 175.7) for £285,000.

Note:

The factory purchased in April 2002 was a replacement for a previous factory which had been purchased for £200,000 on 3 January 1992 (RPI 135.6) and sold for £320,000 on 14 June 2002 (RPI 176.2). Rollover relief was claimed in relation to the June 2002 disposal.

The RPI for December 2017 was 278.1.

Required:

(a) Calculate the chargeable gain arising on the sale of the shares in Hentic Ltd on 28 June 2020.

(b) Calculate the chargeable gain arising on the sale of the factory on 4 March 2021, assuming that a further factory was purchased on 6 November 2020 for £360,000 and that rollover relief is claimed in relation to the March 2021 disposal.

Step by Step Answer: