For many years, W Ltd has owned 70% of the issued shares of X Ltd, 30% of

Question:

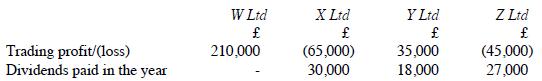

For many years, W Ltd has owned 70% of the issued shares of X Ltd, 30% of the issued shares of Y Ltd and 80% of the issued shares of Z Ltd. All four companies are UK resident and all of the shares of each company are ordinary shares. Results for the year to 31 March 2021 for each company are as follows:

Required:

(a) State (with reasons) which of X Ltd, Y Ltd and Z Ltd are "related 51% group companies" of W Ltd. Also explain how W Ltd might be affected by the fact that it has one or more related 51% group companies.

(b) Explain how the corporation tax computation of W Ltd for the year to 31 March 2021 is affected by the fact that it has received dividends from the other three companies.

(c) Calculate the maximum group relief that can be claimed by W Ltd for the year to 31 March 2021.

(d) Assuming that maximum group relief is claimed, calculate the corporation tax liability of W Ltd for the year to 31 March 2021 and state the date upon which this tax is due for payment.

Step by Step Answer: