Given instruments in the following table (a) Extract the semiannual discount factors for 10 years using the

Question:

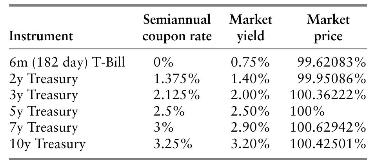

Given instruments in the following table

(a) Extract the semiannual discount factors for 10 years using the bootstrap method with linear and log-linear interpolation in discount factors.

(b) On the same graph, plot the semiannual zero-coupon yields (Formula 2.8 with \(w=0\) ) for \(6 \mathrm{~m}, 1 \mathrm{y}, \ldots, 10 \mathrm{y}\) maturities for linear and \(\log\)-linear interpolation methods.

(c) Using the discount factor curve from the log-linear interpolation, compute the price of a 5 -year, \(1 \%\) semiannual coupon bond and convert the price using Formula 2.5 to a semiannual yield. Do the same with a semiannual coupon rate of \(8 \%\) to observe the coupon effect on yields.

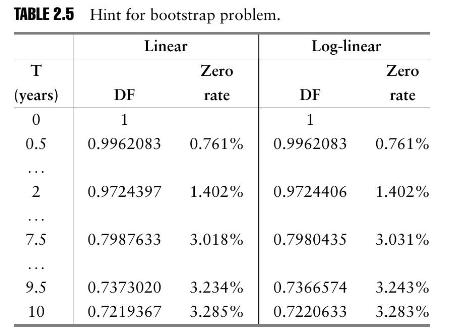

Hint: See Table 2.5

Table 2.5

Step by Step Answer:

Mathematical Techniques In Finance An Introduction Wiley Finance

ISBN: 9781119838401

1st Edition

Authors: Amir Sadr