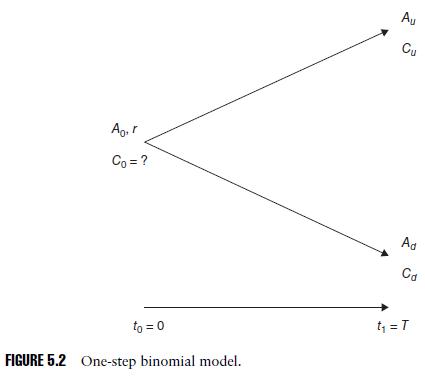

In the 1-step binomial model shown in Figure 5.2, consider the portfolio consisting of one long position

Question:

In the 1-step binomial model shown in Figure 5.2, consider the portfolio consisting of one long position in the contingent claim and short

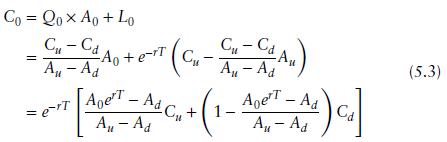

\[Q_{0}=\left(C_{u}-C_{d}ight) /\left(A_{u}-A_{d}ight)\]

of the asset, \(P=C-Q_{0} A\).

(a) Show that the portfolio has the same value at \(t_{1}=T\) regardless of the terminal state \(A_{u}, A_{d}\), that is \(P\left(t_{1}ight)=P_{1}\) for a constant \(P_{1}\) and the portfolio is risk-less.

(b) Using an arbitrage argument, show that today's value of the portfolio should be its discounted future value

\[P_{0}=C_{0}-Q_{0} A_{0}=e^{-r T} P_{1}\]

and compute \(C_{0}\).

(c) Show that the computed value of \(C_{0}\) above is the same as Formula 5.3.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Mathematical Techniques In Finance An Introduction Wiley Finance

ISBN: 9781119838401

1st Edition

Authors: Amir Sadr

Question Posted: