Swift Company was organized on March 1 of the current year. After five months of start-up losses,

Question:

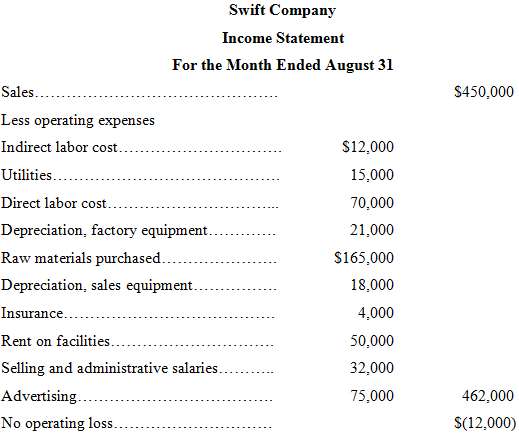

Swift Company was organized on March 1 of the current year. After five months of start-up losses, management had expected to earn a profit during August. Management was disappointed, however, when the income statement for August also showed a loss. Augusts income statement follows.:

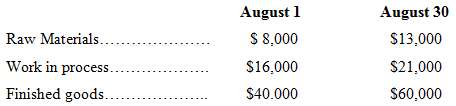

After seeing the $12,000 loss for August, Swifts president stated, I was sure wed be profitable within six months, but our six months are up and this loss for August is even worse than July's. I think its time to start looking for someone to but out the company's assets-f we don't within a few moths there wont be any assets to sell. By the way, I don't see any reason to look for a new controller. Well just limp along with Sam for the time being.The company's controller resigned a month ago. Sam, a new assistant in the controllers office, prepared the income statement above. Sam has had little experience in manufacturing operations. Additional information about the company follows:a. Some 60% of the utilities cost and 75% of the insurance apply to factory operations. The remaining amounts apply to selling and administrative activities.b. Inventory balances at the beginning and end of August were:

c. Only 80% of the rent on facilities applies to factory operations the remainder applies to selling and administrative activities. The president has asked you to check over the income statement and make a recommendation as to whether the company should look for a buyer for its assets.Required:1. As one step in gathering data for a recommendation to the president, prepare a schedule of cot of goods manufactured for August.2. As a second step, prepare a new income statement for August.3. Based on your statements prepared in (1) and (2) above, would you recommend that the company look for a buyer?

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer