Question:

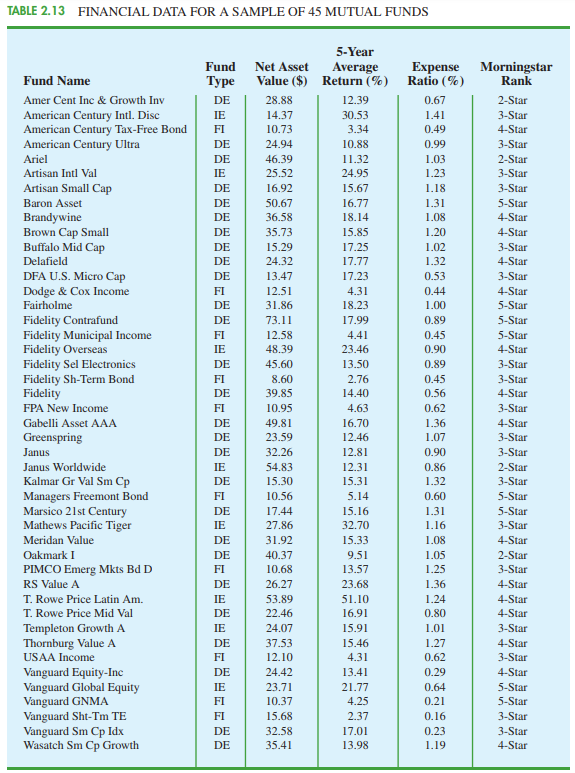

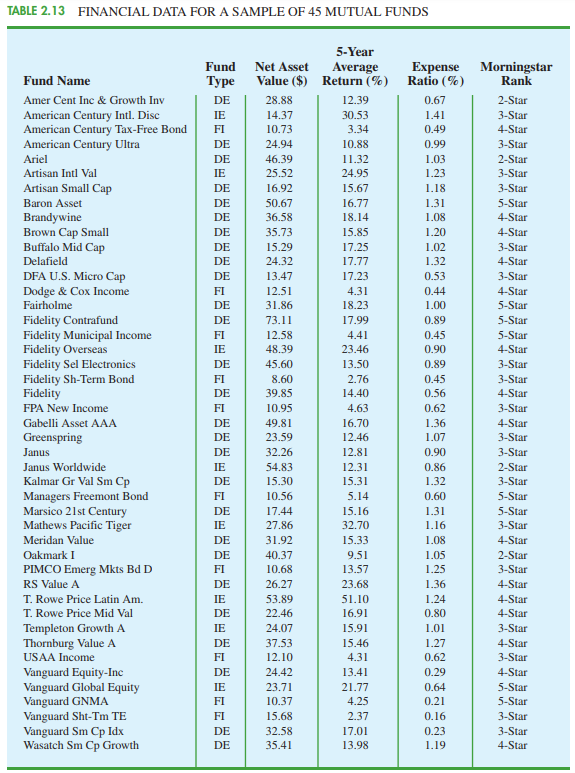

Table 2.13 shows a data set containing information for 45 mutual funds that are part of the Morningstar Funds 500 for 2008. The data set includes the following five variables:

Fund Type: The type of fund, labeled DE (Domestic Equity), IE (International Equity), and FI (Fixed Income)

Net Asset Value ($): The closing price per share

5-Year Average Return (%): The average annual return for the fund over the past 5 years

Expense Ratio (%): The percentage of assets deducted each fiscal year for fund expenses

Morningstar Rank: The risk adjusted star rating for each fund; Morningstar ranks go from a low of 1-Star to a high of 5-Stars

a. Prepare a cross tabulation of the data on Fund Type (rows) and the average annual return over the past 5 years (columns). Use classes of 0-9.99, 10-19.99, 20-29.99, 30-39.99, 40-49.99, and 50-59.99 for the 5-Year Average Return (%).

b. Prepare a frequency distribution for the data on Fund Type.

c. Prepare a frequency distribution for the data on 5-Year Average Return (%).

d. How has the cross tabulation helped in preparing the frequency distributions in parts (b) and (c)?

e. What conclusions can you draw about the fund type and the average return over the past 5 years?

Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Transcribed Image Text:

TABLE 2.13 FINANCIAL DATA FOR A SAMPLE OF 45 MUTUAL FUNDS 5-Year Fund Net Asset Average Return (%) Expense Ratio (%) Morningstar Rank Value ($) Fund Name Type Amer Cent Inc & Growth Inv DE 28.88 12.39 0.67 2-Star 1.41 American Century Intl. Disc American Century Tax-Free Bond American Century Ultra IE 14.37 30.53 3-Star FI 10.73 3.34 0.49 4-Star 10.88 3-Star DE 24.94 0.99 46.39 Ariel DE 11.32 1.03 2-Star Artisan Intl Val IE 25.52 24.95 1.23 3-Star Artisan Small Cap DE 16.92 15.67 1.18 3-Star 1.31 Baron Asset DE 50.67 16.77 5-Star 18.14 Brandywine Brown Cap Small Buffalo Mid Cap Delafield DE 36.58 1.08 4-Star 1.20 DE 35.73 15.85 4-Star 17.25 17.77 1.02 DE 15.29 3-Star 24.32 DE 1.32 4-Star DFA U.S. Micro Cap Dodge & Cox Income Fairholme DE 13.47 17.23 0.53 3-Star 0.44 FI 12.51 4.31 4-Star 18.23 DE 31.86 1.00 5-Star Fidelity Contrafund Fidelity Municipal Income Fidelity Overseas Fidelity Sel Electronics Fidelity Sh-Term Bond Fidelity DE 73.11 17.99 0.89 5-Star 0.45 FI 12.58 4.41 5-Star 48.39 IE 23.46 0.90 4-Star 45.60 0.89 DE 13.50 3-Star FI 8.60 2.76 0.45 3-Star DE 39.85 14.40 0.56 4-Star FPA New Income FI 10.95 4.63 0.62 3-Star 16.70 Gabelli Asset AAA DE 49.81 1.36 4-Star Greenspring DE 23.59 12.46 1.07 3-Star 0.90 Janus DE 32.26 12.81 3-Star Janus Worldwide IE 54.83 12.31 0.86 2-Star Kalmar Gr Val Sm Cp Managers Freemont Bond Marsico 21st Century Mathews Pacific Tiger DE 15.30 15.31 1.32 3-Star FI 10.56 5.14 0.60 5-Star DE 17.44 15.16 1.31 5-Star IE 27.86 32.70 1.16 3-Star Meridan Value DE 31.92 15.33 1.08 4-Star Oakmark I DE 40.37 9.51 1.05 2-Star PIMCO Emerg Mkts Bd D 10.68 FI 13.57 1.25 3-Star RS Value A DE 26.27 23.68 1.36 4-Star 1.24 T. Rowe Price Latin Am. IE 53.89 51.10 4-Star T. Rowe Price Mid Val DE 22.46 16.91 0.80 4-Star Templeton Growth A Thornburg Value A IE 24.07 15.91 1.01 3-Star DE 37. 15.46 1.27 4-Star 0.62 USAA Income FI 12.10 4.31 3-Star 24.42 Vanguard Equity-Inc Vanguard Global Equity Vanguard GNMA Vanguard Sht-Tm TE Vanguard Sm Cp Idx Wasatch Sm Cp Growth DE 13.41 0.29 4-Star 21.77 0.64 IE 23.71 5-Star FI 10.37 4.25 0.21 5-Star 3-Star FI 15.68 2.37 0.16 DE 32.58 17.01 0.23 3-Star 1.19 DE 35.41 13.98 4-Star