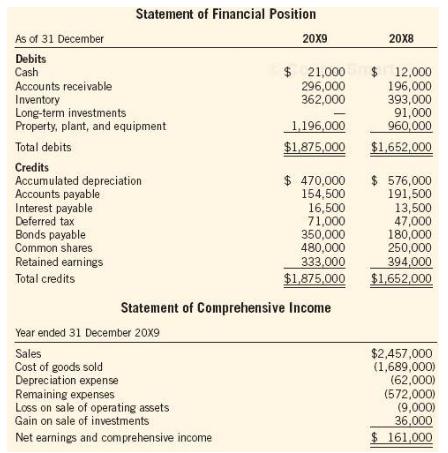

The following data were provided by the accounting records of NewFort Limited at year- end, 31 December

Question:

The following data were provided by the accounting records of NewFort Limited at year- end, 31 December 20X9:

Analysis of selected accounts and transactions:

a. Sold plant assets for cash; cost, $ 252,000; two- thirds depreciated.

b. Purchased plant assets for cash.

c. Purchased plant assets and exchanged unissued bonds payable of $ 190,000 in payment.

d. Sold the long- term investments for cash.

e. Retired bonds payable at maturity date by issuing common shares, $ 65,000.

f. Other changes in asset, liability, and equity accounts flow from logical sources.

Required:

1. Prepare the SCF, using the two- step indirect method to present the operations section. Omit separate disclosure of cash paid for interest and income tax in the operating activi-ties section of the SCF. Include a list of non- cash transactions that would be presented in the disclosure notes.

2. Prepare the operating activities section of the SCF using the direct method.

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0071339476

Volume 1, 6th Edition

Authors: Beechy Thomas, Conrod Joan, Farrell Elizabeth, McLeod Dick I