The following information is for Shiller Company for July 2010: a. Applied factory overhead costs to jobs

Question:

The following information is for Shiller Company for July 2010:

a. Applied factory overhead costs to jobs at the predetermined rate of $39.50 per labor-hour. Job 1467 incurred 6,175 labor-hours; Job 1469 used 4,275 labor-hours.

b. Shipped Job 1467 to customers during July. Job 1467 had a gross margin of 24 percent based on manufacturing cost.

c. Job 1469 was still in process at the end of July.

d. Closed the overapplied or underapplied overhead to the Cost of Goods Sold account at the end of July.

e. Factory utilities, factory depreciation, and factory insurance incurred is summarized by these factory vouchers, invoices, and cost memos:

Utilities ...........$ 14,250

Depreciation .......... 85,500

Insurance .......... 11,875

Total ............ $111,625

f. Purchased the following direct materials and indirect materials:

Material A ......... $ 25,000

Material B ......... 43,000

Indirect materials ....... 218,650

Total ............$286,650

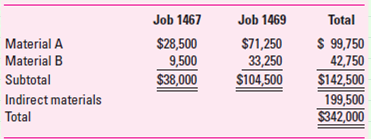

g. Direct materials and indirect materials used are as follows:

h. Factory labor incurred for the two jobs and indirect labor is as follows:

Job 1467 ........ $76,000

Job 1469 ........ 57,000

Indirect labor ...... 133,000

Total ..........$266,000

Required

1. Calculate the amount of overapplied or underapplied overhead and state whether the cost of goods sold account will be increased or decreased by the adjustment.

2. Calculate the total manufacturing cost for Job 1467 and Job 1469 for July2010.

Step by Step Answer:

Cost management a strategic approach

ISBN: 978-0073526942

5th edition

Authors: Edward J. Blocher, David E. Stout, Gary Cokins