The following is Sullivan Corp.'s comparative balance sheet accounts at December 31, 2010 and 2009, with a

Question:

The following is Sullivan Corp.'s comparative balance sheet accounts at December 31, 2010 and 2009, with a column showing the increase (decrease) from 2009 to 2010.

Additional information:

1. On December 31, 2009, Sullivan acquired 25% of Myers Co.'s common stock for $275,000. On that date, the carrying value of Myers's assets and liabilities, which approximated their fair values, was $1,100,000. Myers reported income of $140,000 for the year ended December 31, 2010. No dividend was paid on Myers's common stock during the year.

2. During 2010, Sullivan loaned $300,000 to TLC Co., an unrelated company. TLC made the first semiannual principal repayment of $50,000, plus interest at 10%, on December 31, 2010.

3. On January 2, 2010, Sullivan sold equipment costing $60,000, with a carrying amount of $38,000, for $40,000 cash.

4. On December 31, 2010, Sullivan entered into a capital lease for an office building. The present value of the annual rental payments is $400,000, which equals the fair value of the building. Sullivan made the first rental payment of $60,000 when due on January 2, 2011.

5. Net income for 2010 was $370,000.

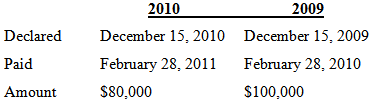

6. Sullivan declared and paid cash dividends for 2010 and 2009 as shown below.

Prepare a statement of cash flows for Sullivan Corp. for the year ended December 31, 2010, using the indirect method.

(AICPAadapted)

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield