The information shown below relating to the ending inventory was taken at lower of cost or NRV

Question:

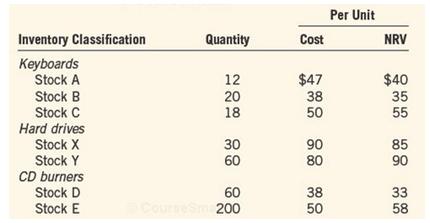

The information shown below relating to the ending inventory was taken at lower of cost or NRV from the records of Components Corporation:

Required:

1. Determine the valuation of the above inventory at cost and at lower of cost or NRV, assuming application of lower- of- cost- or- NRV valuation by

(a) Individual items, and

(b) Classifications.

2. Give the entry to record the writedown, if any, to reduce ending inventory to lower of cost or NRV. Assume periodic inventory and the allowance method.

3. Of the two applications described in (2) above, which one appears preferable in this situation? Explain.

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 978-0071339476

Volume 1, 6th Edition

Authors: Beechy Thomas, Conrod Joan, Farrell Elizabeth, McLeod Dick I

Question Posted: