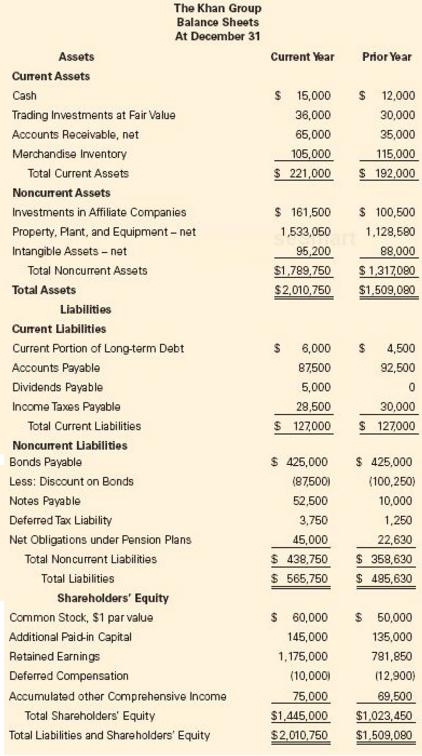

The Khan Group provided its balance sheet and income statement as of December 31 of the current

Question:

The Khan Group provided its balance sheet and income statement as of December 31 of the current year.

The Khan Group

Income Statement

For the Year Ended December 31

Current Year

Sales………………………………………………… $ 2,212,040

Cost of Goods Sold………………………………… 1,327,224

Gross Profit…………………………………………. $ 884,816

Selling, General, and Administrative Expenses…….. $ 43,000

Unrealized Losses…………………………………… $ 3,600

Pension Expense…………………………………….. 210,500

Bad Debt Expense…………………………………... 1,500

Depreciation Expense……………………………….. 17,700

Amortization Expense………………………………. 6,750

Total Operating Expenses…………………………… $ 283,050

Income before Interest and Taxes…………………… $ 601,766

Interest Expense…………………………………….. $ (50,100)

Investment Income (includes gain on sale)…………. 50,000

Equity Earnings from Affiliate Companies…………. 118,500

Income before Tax…………………………………... $ 720,166

Income Tax Expense………………………………… (288,066)

Net Income………………………………………….. $ 432,100

Additional Information:

1. The company classifies its current investments as trading securities. It sold securities with a cost of $ 34,500 during the current year. Treat the trading securities as an investing activity.

2. The company reported accounts receivable net of the allowance for bad debts.

3. The company acquired equipment during the year and made no disposals. Paid cash.

4. The company included a $ 40,500 gain on the sale of investments in investment income on the income statement.

5. The change in accumulated other comprehensive income is due to pension adjustments.

6. There were no additional investments in affiliate companies during the year.

Required:

Prepare the company’s cash flow statement for the current year under the indirect method. Provide all required disclosures.Step by Step Answer:

Intermediate Accounting

ISBN: 978-0132162302

1st edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella